How to Understand K1s for Real Estate Syndications

When investing in a real estate syndication, you will receive a tax document called a Schedule K-1 (Form 1065) each year. Understanding how a K-1 works is important to know as a passive investor.

In this article, we’ll go over what a K-1 is, how to read a K-1 and the tax implications of investing in a real estate syndication.

What is a K-1?

Schedule K-1 is a tax form used to report your income from a pass-through entity such as a real estate partnership. The K-1 reports your share in the partnership’s income, losses, deductions and credits.

With real estate syndications, multiple investors come together in either a limited partnership or limited liability company (LLC) to invest in a property. The partnership itself does not pay taxes, rather the individuals in the partnership pay their own share of taxes. Because you get direct ownership interest when investing in a real estate syndication, you also share in the property’s income and expenses, as well as the pass-through tax advantages.

The K-1 tax form is provided to you by the general partners. You will then file the K-1 with your personal tax return.

Overview of the K-1

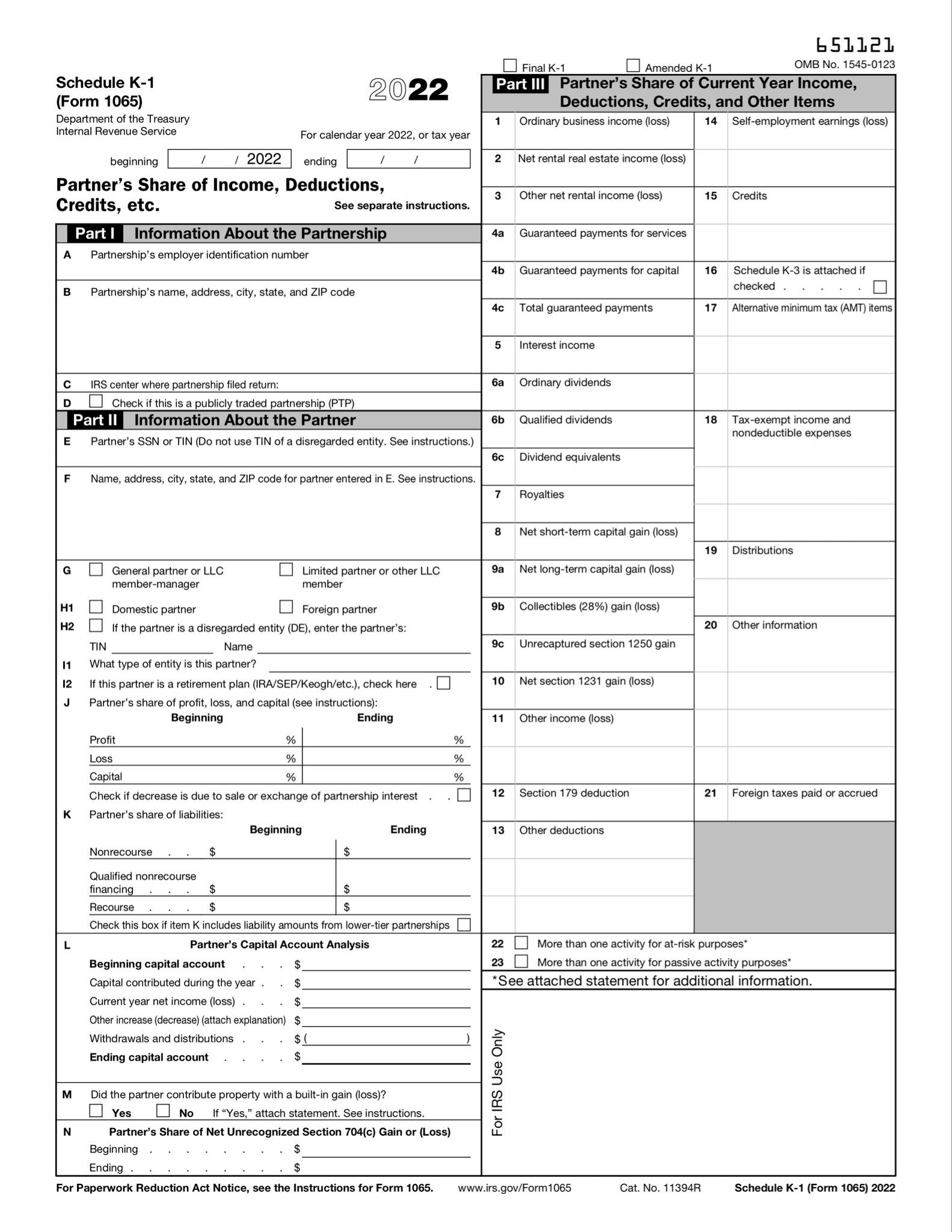

Below is a copy of Schedule K-1:

You can also get a sample K-1 here by visiting the IRS website.

Schedule K-1 is divided into three parts:

- Part I provides information about the partnership. This section includes information about the company, including the company’s name, address and employer identification number.

- Part II provides information about you as the individual investor and your ownership interest.

- Part III reports your share in the current year’s income, deductions, credits, and other items.

Key Sections of a K-1 to Know as a Passive Investor

While there are many sections on a K-1, four key sections are especially important to understand as a passive investor:

- Part II, Box J: Partner’s share of profit, loss and capital

- Part II, Box L: Partner’s capital account analysis

- Part III, Box 2: Net rental real estate income (loss)

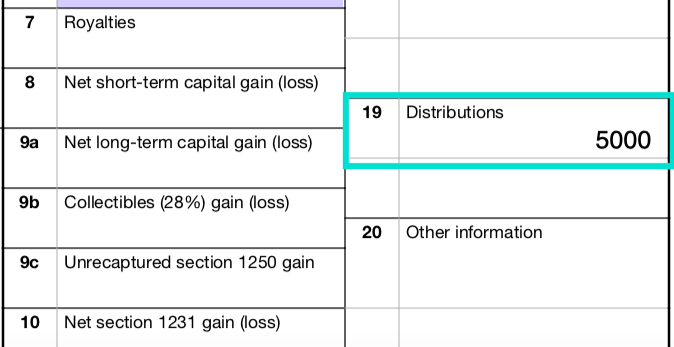

- Part III, Box 19: Distributions

Let’s go over each of these sections:

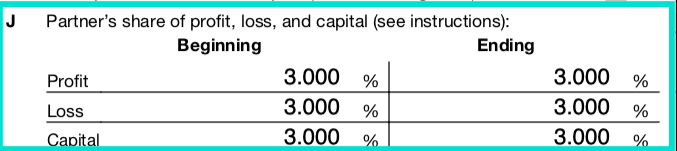

Box J: Partner’s Share of Profit, Loss, and Capital

Box J shows a breakdown of your ownership percentage in the deal. For instance, if the partnership raised $5,000,000 and you contributed $150,000, you have a 3% ownership.

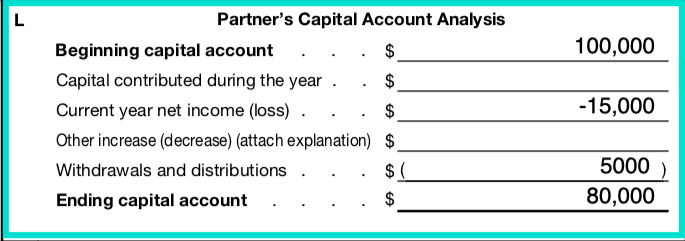

Box L: Partner’s Capital Account Analysis

Box L shows an investor’s capital account. The capital account shows your original contribution to the investment. The capital balance is increased by any additional contributions made, and decreased by any taxable losses and any distributions.

For instance, in the example above, an investor puts $100,000 into a real estate syndication. She received $5000 in distributions and had a “paper loss” of $15,000. The ending capital balance is $80,000.

The ending capital balance is important because this is your tax basis in the partnership at the end of each year. If you were to liquidate your partnership interest, you would subtract this number on the ending capital balance from the sales proceeds to estimate the capital gains of the sale.

-

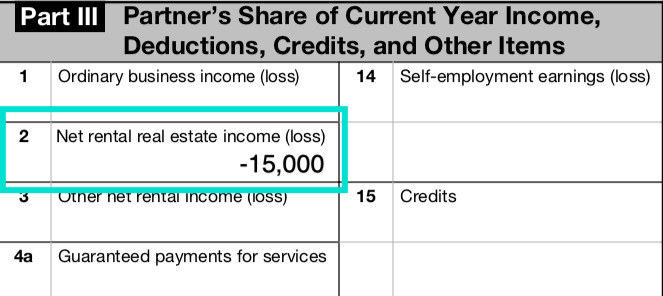

Box 2: Net Rental Real Estate Income (Loss)

Box 2 reflects your share of the net rental income for the year. This number includes income, operating expenses and depreciation deductions. The depreciation deduction is subtracted from the net operating income (income – operating expenses), which gives the net rental real estate income.

In many cases, the number in Box 2 is negative and shows a loss, even if you actually made money by getting distributions during the year. This is because the depreciation amount (usually due to accelerated depreciation) exceeds the net income.

For example, if you received $5000 in distributions for the year, but have a $20,000 depreciation deduction, then the net rental real estate income would be reported as -$15,000.

Box 19: Distributions

Box 19 shows the distributions paid to you during the year. This number is not reported as taxable income on your income tax return. Instead this number is simply carried to Part II, Section L as noted in #2 above.

How is K-1 income taxed?

To understand the tax treatment for real estate syndications, you need to first understand how the IRS classifies different types of income. The IRS classifies income into three categories: active, portfolio, and passive.

- Active Income: This includes all earned income (wages, tips, active business participation). Real estate investment income is only considered active income if you qualify as a real estate professional. In this case, you can use the losses from rental income to offset nonpassive income. The general partners in a syndication deal are typically real estate professionals, but you as the passive investor do not qualify, so you cannot use rental income to offset any active income.

- Portfolio Income: This is investment income such as capital gains, interest, and dividends. While stocks and bonds are often referred to as “passive” investments, the IRS actually treats this income as portfolio income, distinct from passive income.

- Passive Income: This includes income earned from rents, royalties, and limited partnerships. For most passive investors, real estate investment income is classified as passive income. What this means is that you can only deduct the passive losses from a real estate syndication against other passive income (not any active or portfolio income). For instance, a $10,000 loss on real estate syndication could offset a $10,000 passive income from another rental property. But these losses cannot be used to offset active income, like your W2 or 1099 income as a physician.

Conclusion

Understanding the Schedule K-1 is an important part of being a passive investor in real estate syndications. Think of the K-1 like your report card for the year about your share in the investment partnerships’s income, losses, deductions and credits.

If you’re interested in learning more about how real estate syndications work, please contact us. We would love to be a part of your real estate journey.

DISCLAIMER: This article is for educational purposes only. I am not a tax professional and this is not tax advice. Please consult with your CPA.