The key to financial literacy and financial success begins with understanding your personal financial statement.

A personal financial statement? What’s that?

Sure, you may have heard of a personal statement before…you know, the one you had to write to get into medical school explaining why you wanted to be a doctor.

But you’ve probably never heard of a personal financial statement. Most of us are not taught this stuff, even after years and years of school.

In this article, I’m going to explain what a personal financial statement is, the differences between the poor, middle class, and the rich, and how you can model the financial statement of the rich.

What is a Personal Financial Statement?

A personal financial statement provides an overview of your finances at a particular moment in time.

Robert Kiyosaki, the author of “Rich Dad Poor Dad,” says that there are six basic words to financial literacy and financial intelligence: income, expense, asset, liability and cash flow.

The secret to financial intelligence and being rich is whether you can control cash flow. And the personal financial statement allows us to see where the cash is flowing.

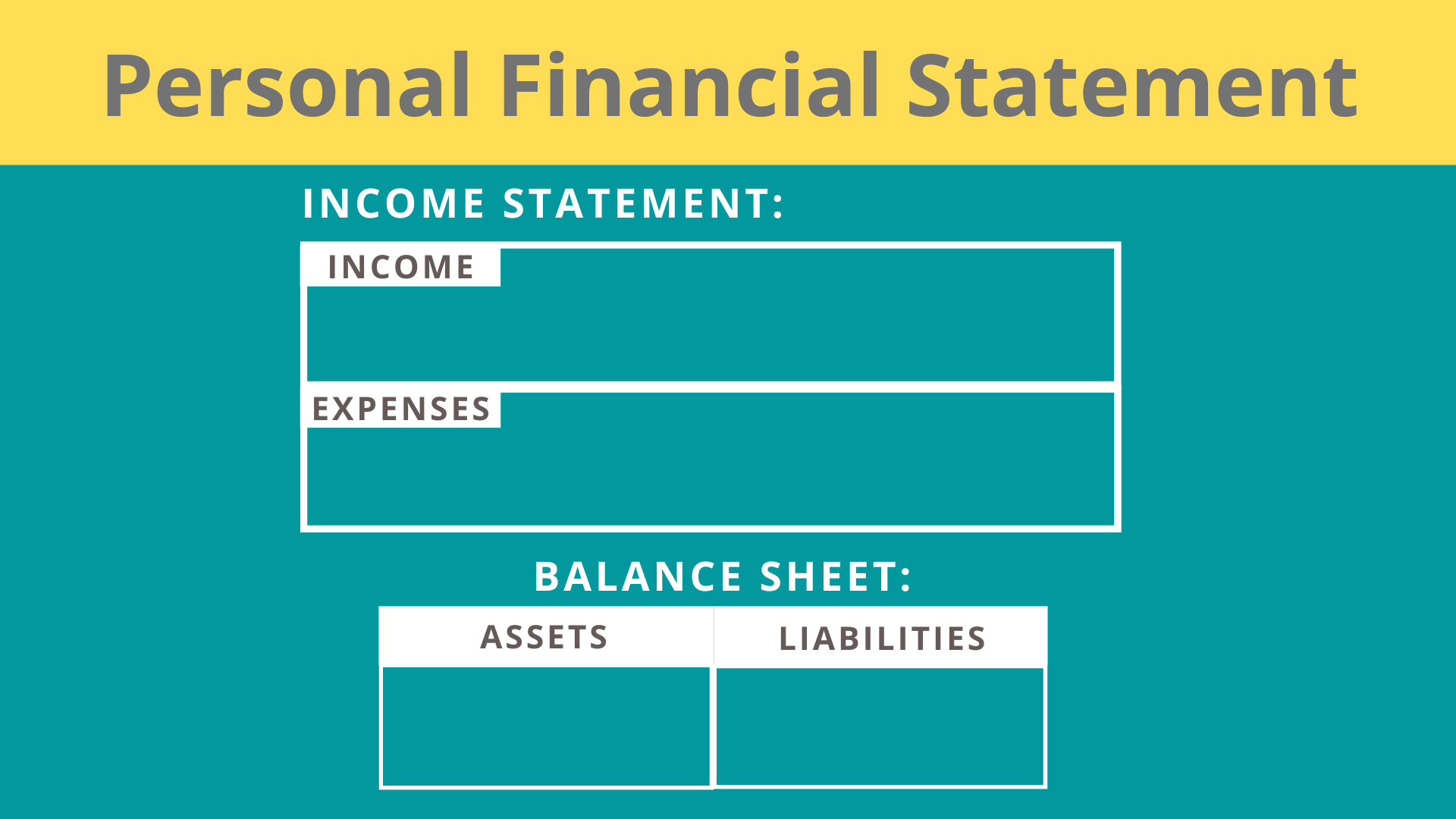

A financial statement consists of two parts: an income statement and a balance sheet.

Income Statement

The income statement consists of two parts: income (money coming in) and expenses (money going out).

The income statement allows you to see how much you make and how much you spend.

There are three types of income:

- Ordinary Income (money you work for, like wages, tips, salaries or commissions)

- Portfolio Income (profits from any investment sales, like those from stocks, businesses and real estate)

- Passive Income (such as from rental properties, limited partnerships or royalties).

Ordinary income is taxed at the highest level. Portfolio income is taxed at a lower rate, and passive income is taxed at the lowest rate.

The expenses section of the personal financial statement consists of anything you pay for each month, such as your rent or mortgage payment, car payment, student loans, food, utilities, and insurance.

Balance Sheet

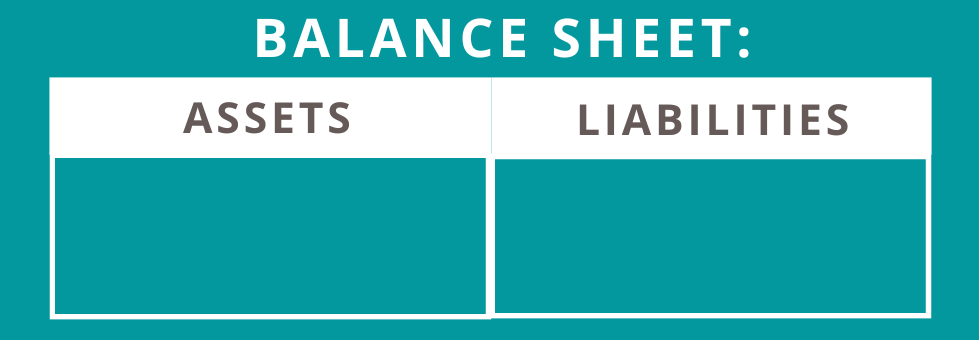

Now let’s talk about the other part of the personal financial statement: the balance sheet. The balance sheet shows you what you own and owe, and consists of two parts: assets and liabilities.

I like Robert Kiyosaki’s definition of an asset and liability. It’s pretty simple. An asset is something that puts money in your pocket and a liability is something that takes money out of your pockets.

The relationship between the income statement and balance sheet is important. You have to understand one to understand the other, and seeing the connection between the two is key to understanding how wealth is created.

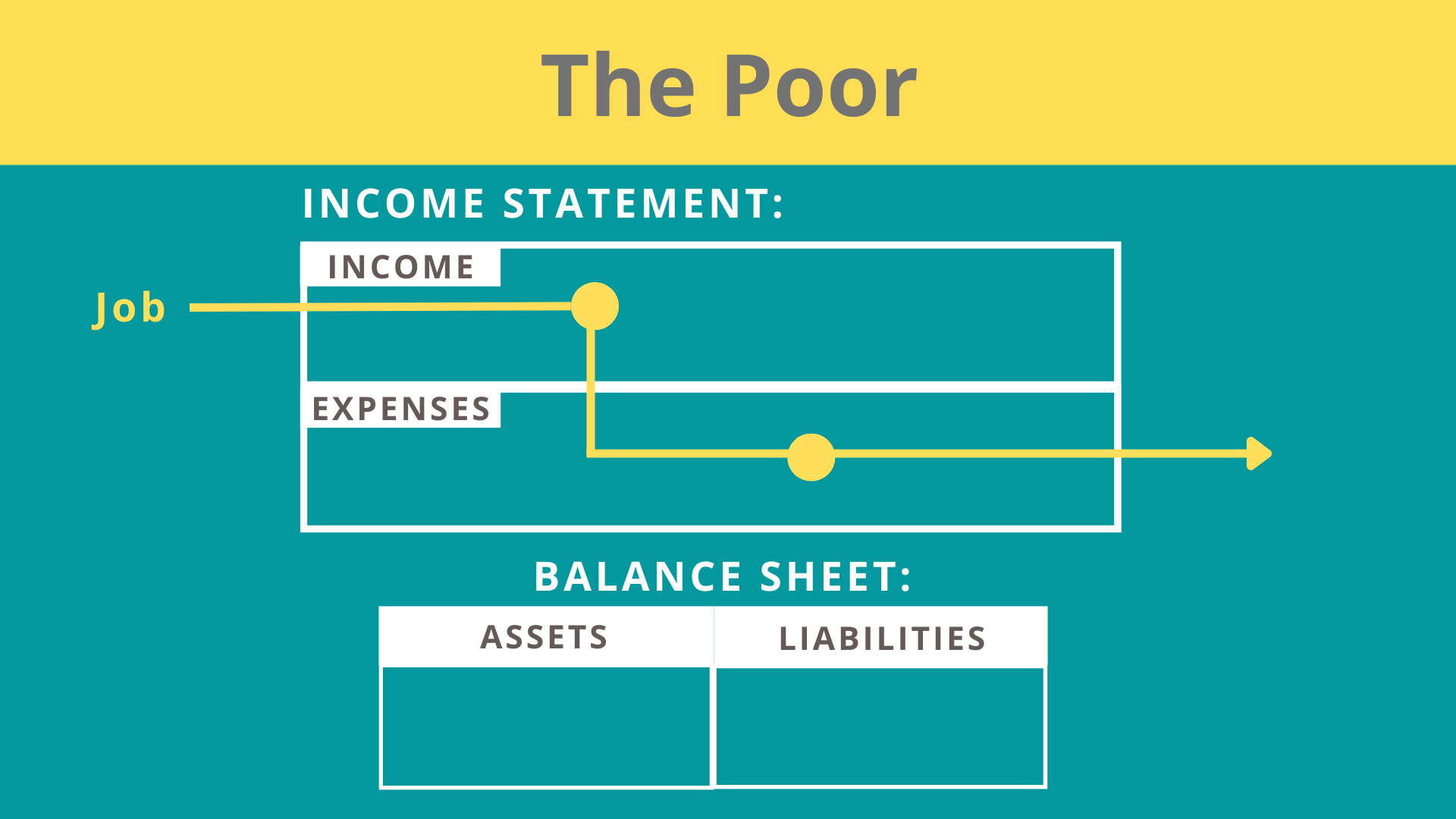

Financial Statement of the Poor

Let’s first look at the cash flow pattern of the poor.

The yellow line in the diagram represents where cash flows.

For the poor, the income comes in from a job and then goes straight out to cover expenses. They can’t control the cash flowing out through their expenses.

This is why financial gurus like Suze Orman and Dave Ramsey tell us to cut up our credit cards and live below our means, because most people can’t control their cash flow and spend more than they earn.

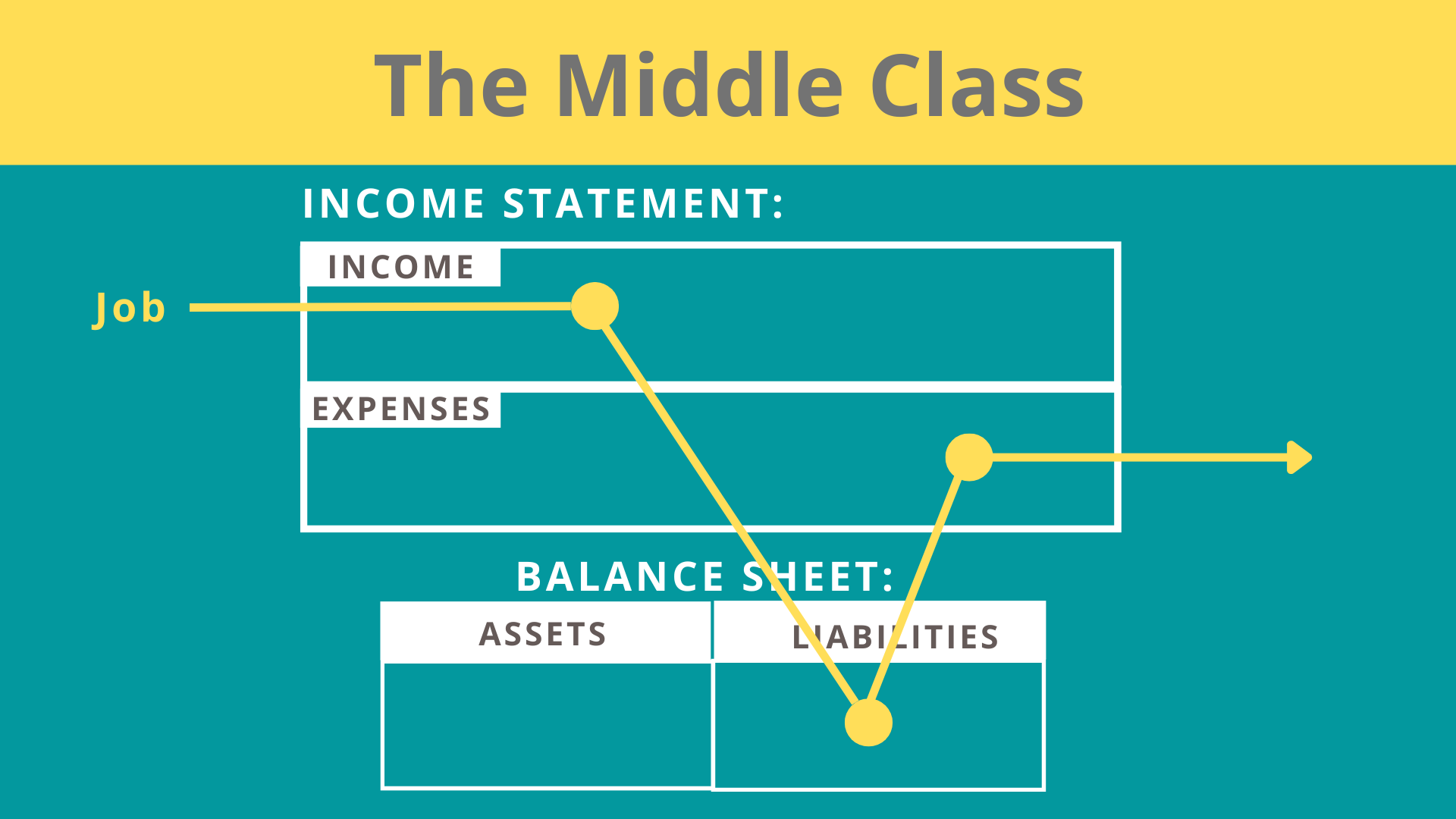

Financial Statement of the Middle Class

This is the cash flow pattern of the middle class. Most physicians and other high-income professionals fall into this category.

Money comes in from their job, which they use to buy liabilities that they then have to pay expenses for. Think of physicians who go from being residents to becoming attendings. After years of delayed gratification, they finally start earning money, so they go out to buy nice houses and new cars.

What they may not realize is that they are actually buying liabilities, because these things don’t earn them any income and have expenses associated with them (think gas, insurance, and maintenance costs). So most of us go to work and earn money only to pay for the expenses that these liabilities create.

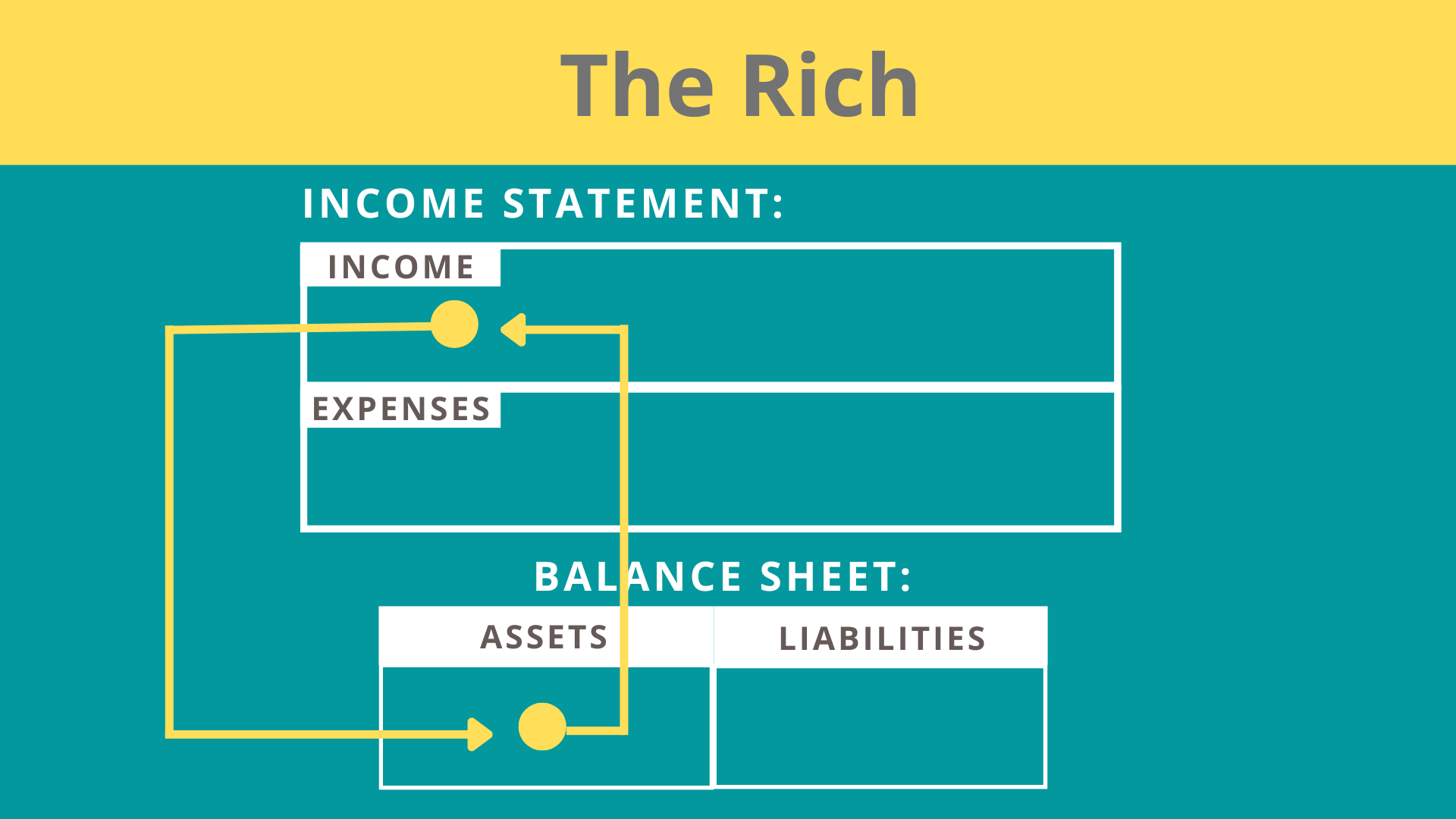

Financial Statement of the Rich

This is the cash flow pattern of the rich.

Income is used to purchase assets. These assets in turn produce their own income, which can be used to buy more assets. This creates a positive feedback loop by bringing more and more money back into the income box. Furthermore, the income these assets create is not earned income but passive income, which is the lowest taxed income.

How Physicians Can Model the Financial Statement of the Rich

As physicians, the traditional way we’ve been taught to make and spend money – go to school, get through residency, earn a “good” income, buy a nice house and car – is so counterintuitive to what the rich do.

To model the cash flow pattern of the rich, we want to use the income we earn to purchase assets, and allow these assets to produce their own income, which we can use to buy even more assets (and splurge on some liabilities). This positive feedback loop is the goal to mimicking the financial statement of the rich. By creating this positive feedback loop, you make money work hard for you.