Passive real estate investors often have two types of investment options available to them: single-asset syndications and funds. In this article, we’ll go over these two investment types and discuss the pros and cons of each.

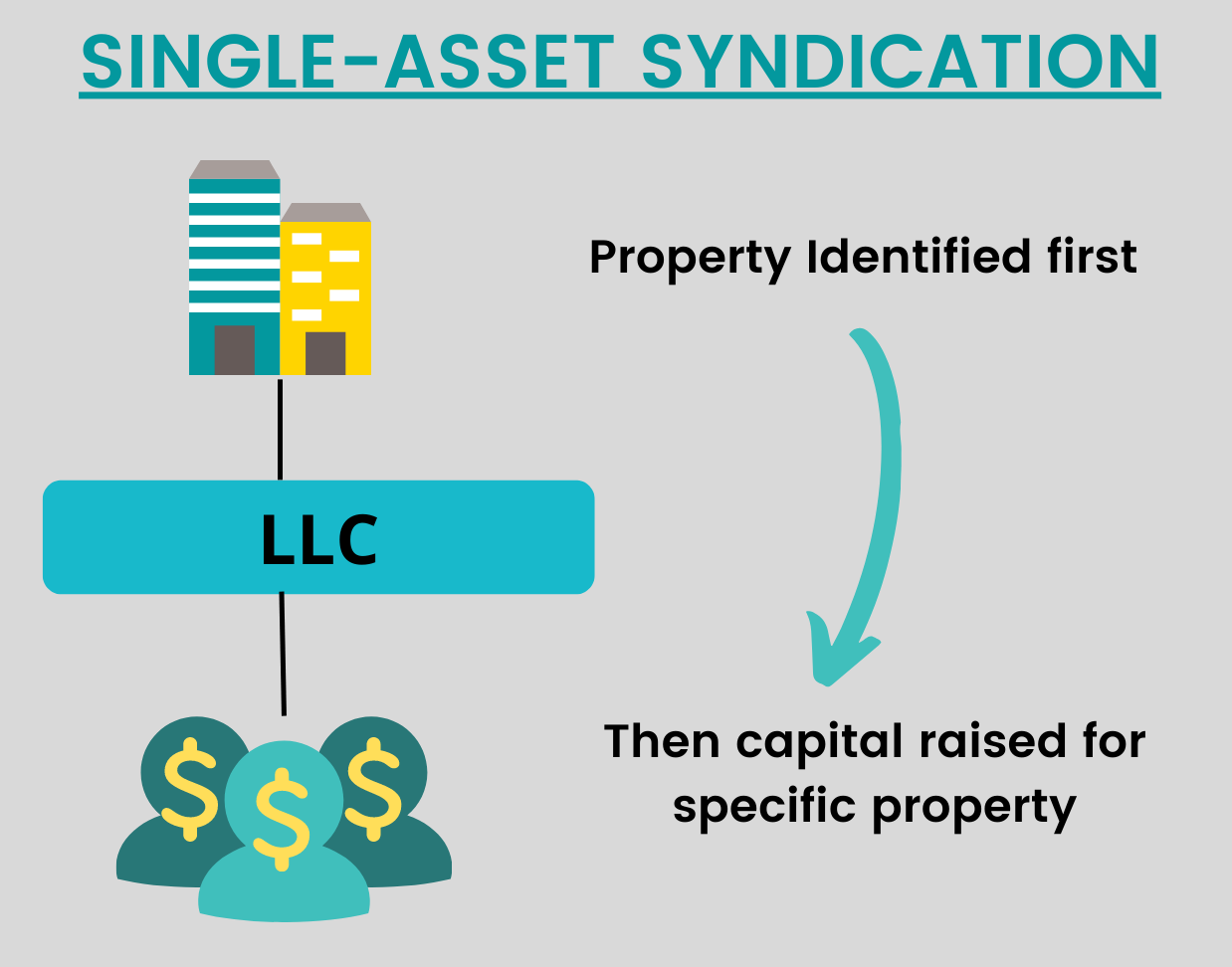

Single-Asset Syndications

The single-asset syndication model is the most common type of deal structure. In this model, the sponsor identifies a property first, then raises capital for the specific deal.

Pros of Single-Asset Syndications:

-Control over Asset Selection

The main benefit of single-asset syndications is the control you have over your investment. Unlike a fund, you can identify the specific property, analyze proformas, confirm inspections, evaluate the market, and dive into the specific business plan for the property.

-No Cash Drag

When you invest in a single-asset syndication, your entire investment capital is placed into the deal. On the other hand, funds will typically require a capital commitment but the sponsor may only call for a portion of the funds at any given time.

Cons of Single-Asset Syndications:

-Concentration of Risk

A single asset syndication puts all your eggs in one basket. If the property performs poorly, then your entire investment is at risk.

-Urgent Timeframes

There are short funding deadlines for single-asset syndications. Funding is typically open for 30-60 days. When a deal opens, you have a relatively short time to review the investment, conduct due diligence, sign the paperwork and transfer the funds.

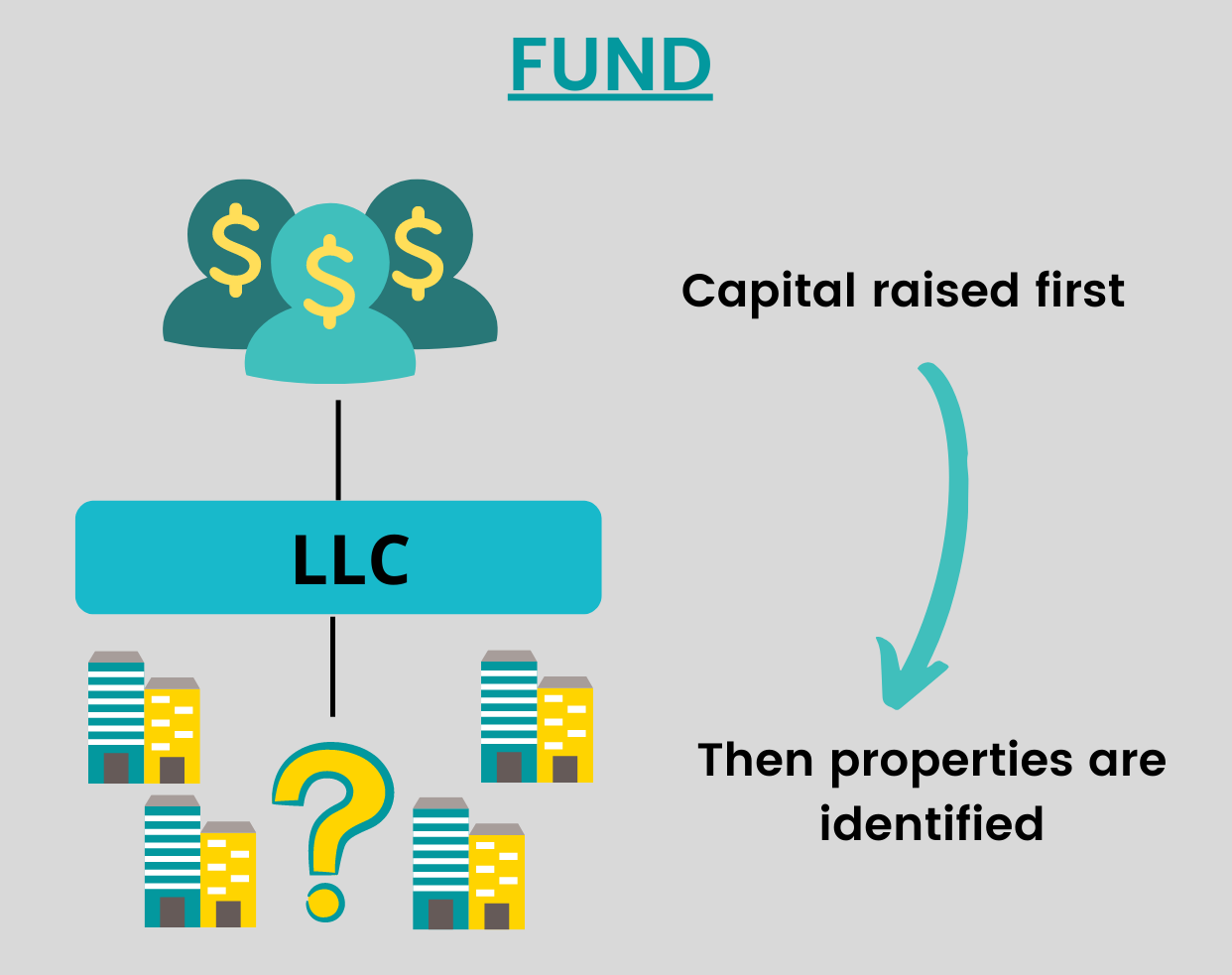

Funds

A fund raises capital from investors upfront and uses it to acquire multiple real estate properties that fit the fund’s investment criteria. Unlike a single-asset syndication, the money is raised first and then the properties are acquired. The sponsor will typically get commitments before identifying any, or most, of the properties.

Investors are sometimes given information about the property characteristics that the fund can purchase. For example, a fund can say that they are seeking 100-200 unit value-add apartment buildings in Atlanta, Georgia, in class-B neighborhoods, built between 1980-2000. In this case, you’ll have some parameters as to what the sponsor can purchase.

Pros of Funds:

-Diversification

Funds allocate capital across multiple properties (and sometimes across multiple markets), so you get diversification of your invested capital. You get exposure to multiple assets within a single investment.

-Risk Mitigation:

Your risk is reduced by spreading your capital across multiple deals. A property that’s underperforming can be offset by the performance of the other assets in the fund.

-Less Urgent Timelines

Compared to single-asset syndications, timelines are less urgent for funds. Many funds are open and accept new investors on a rolling basis. This means that you have more time to review the offering, look at the paperwork and fund the investment.

Cons of Funds:

-No Control Over Asset Selection:

Although some funds will identify one or a few properties prior to the offering being launched, not all the assets are identified. You won’t be able to choose and vet every property in the fund.

A high degree of trust in the sponsor is needed here, more so than in a single-asset syndication. You have to trust that the sponsor will make the right decision, purchase the right assets and invest your money wisely.

-Complexity in Taxes

Investing in a fund can add an extra layer of complexity to taxes compared to single-asset syndications. Funds can result in tax liability in multiple states.

-Cash Drag

When you invest in a fund, you will typically commit a certain amount of money but the sponsor only calls a portion of that commitment. You need to keep the remaining funds available for when the sponsor calls the capital to fund a deal.

For instance, if you commit $100K to a fund and the sponsor only calls for $50K for the first acquisition, then you’ll need to keep the remaining committed capital available. This may not be appealing given that you’ll likely have to keep that money liquid in a savings or checking account, earning very low (or zero) interest.

Conclusion

Both single-asset syndications and funds offer great options to invest passively in real estate. With both structures, it is still important to vet the sponsor and make sure that their vision and strategy aligns with your investment goals.

Below are some questions to ask yourself as you consider whether to invest in a single-asset syndication or a fund:

- What’s more important to you as an investor: diversification or a calculated risk on a single asset?

- What is the sponsor’s track record and your personal experience investing with them?

- Does the sponsor’s investment strategy and risk tolerance align with yours?

Interested in learning more about passive real estate investing? Start by joining our Clear Vision Investor Club.