Real Estate Depreciation Explained

Many physicians and other high-income earners make a great living, but end up paying 40-50% of what they earn in taxes each year.

Most of us grumble about paying high taxes, but we just usually pay it each year and move on.

But the wealthy know that it’s not what you make that matters, but what you keep. And taxes are our biggest expense.

In this article, we’ll talk about one of the magical tax advantages of investing in real estate: depreciation. We’ll go over what depreciation is and how it works, the different types of depreciation, and how depreciation helps with tax savings.

What is Depreciation?

Depreciation lets you write off the value of an asset over time. The IRS recognizes that nothing lasts forever and that everything eventually wears out.

Think of your computer, your cell phone, or the equipment in your clinic and surgery center. Over time, they slow down, the battery wears out, and eventually they die out and are worth very little. This is the concept of depreciation.

The same is true for real estate. Under the IRS definition, depreciation is a ”tax deduction that allows a taxpayer to recover the cost of a property over time. It is an annual allowance for the wear and tear, deterioration, or obsolescence of the property.”

Everything except the land itself – the building, heating and plumbing systems, landscaping, driveways, parking lots, appliances, carpet, paint, windows – all wear out and lose their value.

As the property wears out and “loses” its value, the IRS allows those losses to be written off.

Here’s the beauty of depreciation:

Although real estate generally increases in value over time, the IRS allows you to claim depreciation as if it were losing value.

Another great thing about depreciation is that the amount you’re able to write off is not dependent on how much money you put down into the deal. Rather, it’s based on the value of the property.

So if the property is worth $500,000, you take the same depreciation whether you put 100% down, 20% down or 0% down!

The Different Types of Depreciation

Now that you have an understanding of what depreciation is, let’s talk about the different types of depreciation:

- Straight-Line Depreciation

- Accelerated Depreciation

- Bonus Depreciation

Straight-Line Depreciation

There are a couple different ways you can track depreciation but the simplest is to just find how long it will take the asset to completely fall apart (also known as its “useful life”), and then divide how much you paid for it by that many years.

This method is called “straight line depreciation”, as you end up claiming the same amount of depreciation every year.

The IRS dictates the depreciation life for different types of assets.

If a property is non-residential (i.e. office building, hotel, shopping center), the cost of the structures is written off over 39 years.

For residential properties (houses, apartments), it’s written off over 27.5 years.

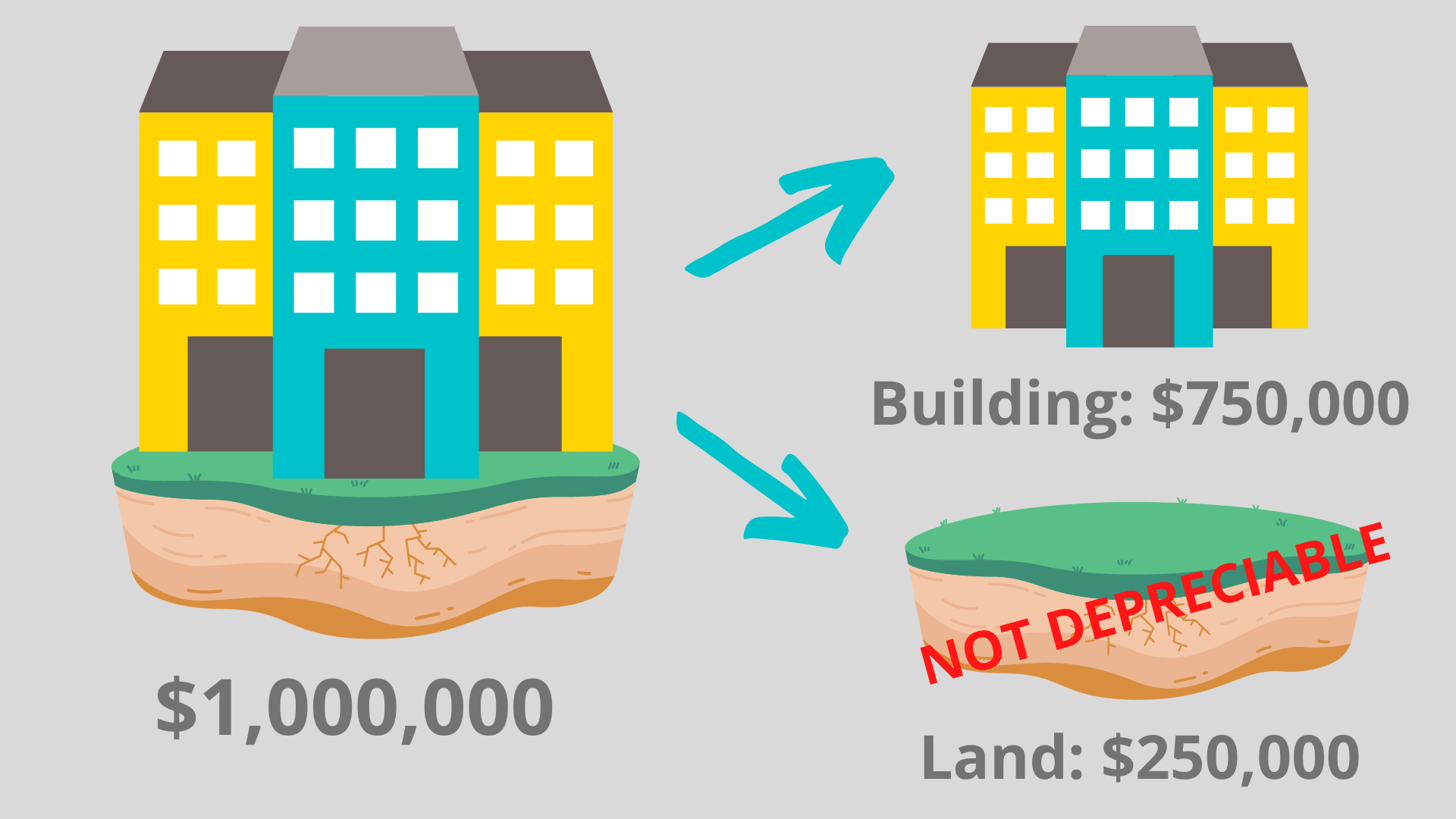

Land is not depreciable. When you buy a property, you buy both the building and the land that the building sits on. While the building can be depreciated, the land cannot be. So you have to split the price into two components: land and building.

To calculate a property’s depreciation schedule, you have to first deduct the value of the land the property sits on because the land isn’t depreciable.

So let’s take an example:

Let’s say you purchase a building for $1,000,000, and 25% of this is the land value- then your building’s value is $750,000.

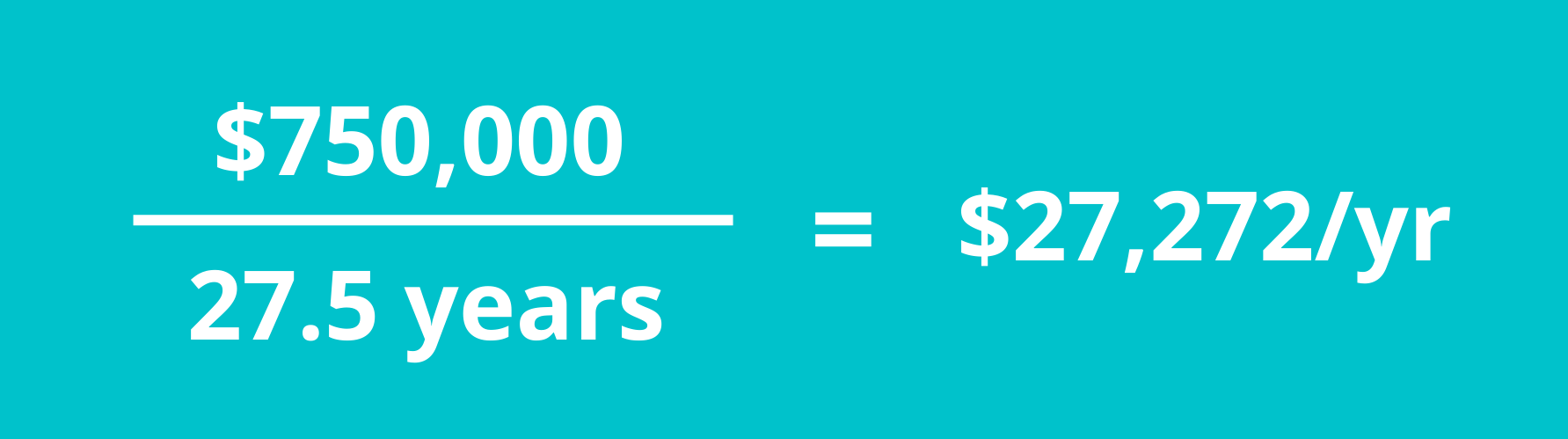

You divide the building value of $750,000 by 27.5 years (the number of years that the IRS presumes your building wears out):

That gives you $27,272 worth of passive losses each year.

As a passive investor, let’s say you invest $50,000 into the above property and you have 25% ownership.

Your 25% ownership in the deal gives your 25% of the deprecation.

So of the $27,272 depreciation for the year, you get 25% of $27,272, or $6818.

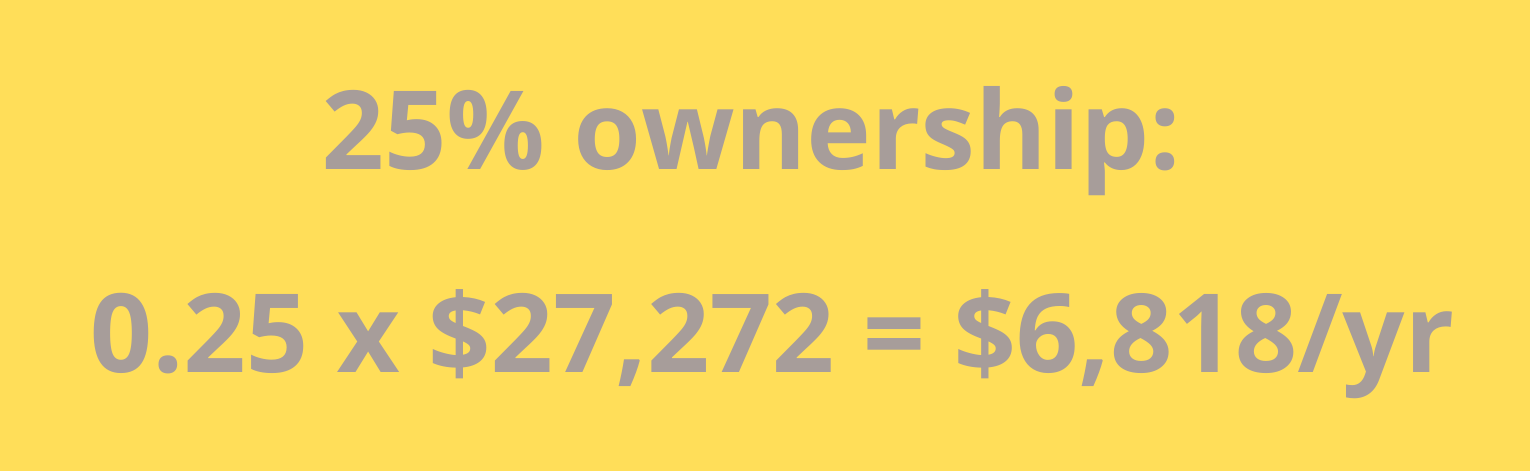

Let’s say In year one, you receive $5,000 in cash flow distributions.

Although you received $5000 in cash flow, you get to write off $6818 in losses, meaning you don’t pay anything on the cashflow you received.

Accelerated Depreciation

Accelerated depreciation allows investors to take depreciation losses in the early years of owning the property, rather than waiting to take it slowly over time.

All parts of a building do not wear out at the same rate. A stove won’t last as long as a building, and the carpet will depreciate faster than the parking lot.

The IRS recognizes these differences and allows us to write off the different parts of a building according to an accelerated depreciation schedule for each item.

Rather than depreciating the entire amount over 27.5 years, cost segregation breaks out the components of the building into smaller parts.

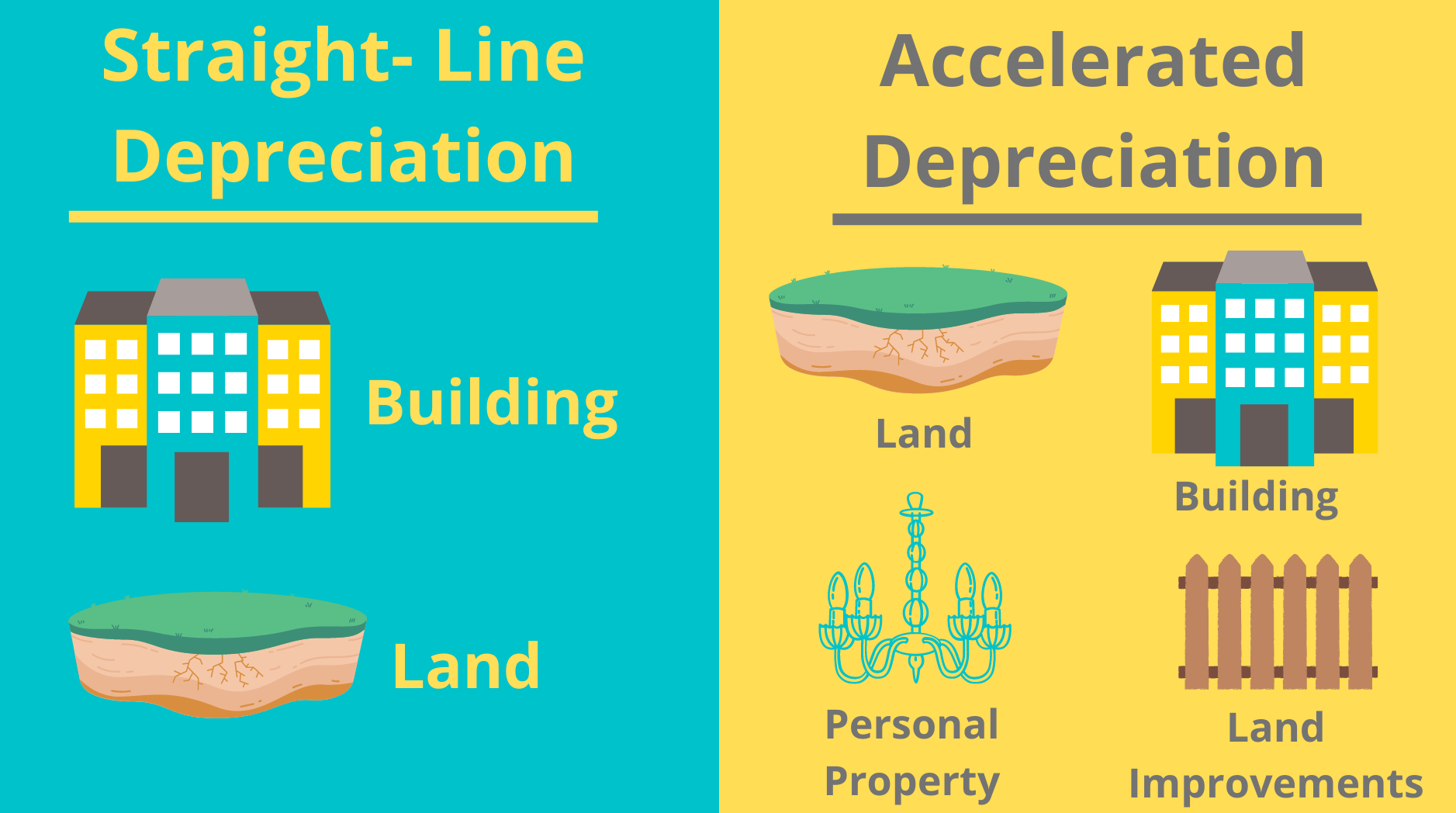

With straight line depreciation, you separate things out into only two components: land and building.

With a cost segregation study, you separate out the property into 4 categories:

- Land (not included in depreciation)

- Building (expensed over 27.5 years for residential and 39 years for commercial)

- Personal property (property that you have a hand in choosing, like bathroom fixtures, caparet, cabinets): can be expensed over 5 or 7 years

- Land improvements (such as sidewalks, fencing, parking, landscaping): can be expensed over 15 years

Ultimately, how quickly you can benefit from accelerated depreciation comes down to how much of your property falls into each of the IRS’s four different categories above.

A third-party engineering firm can do a cost segregation analysis and decide which things should go into each category, and provide a detailed depreciation schedule for the property.

Cost segregation studies result in higher depreciation deductions in the early years of ownership. Since most syndication deals are owned for around 5 years, cost segregation is often used to maximize the depreciation that can be taken during the life of the investment.

It’s important to note that cost segregation does not mean you get any extra depreciation. It simply means you’re speeding up the depreciation and receiving the tax benefit earlier.

Bonus Depreciation

Bonus depreciation allows the depreciation timeline to be accelerated even further and taken earlier in the lifespan of the property.

The Tax Cuts and Jobs Act (TCJA) passed in 2017 states that “if a property was/is purchased after 9/27/2017 and before 1/1/2023, then it qualifies for bonus depreciation.”

Bonus depreciation allows an investor to deduct the entire cost of an improvement with a useful life of 20 years or less in the year the cost is incurred.

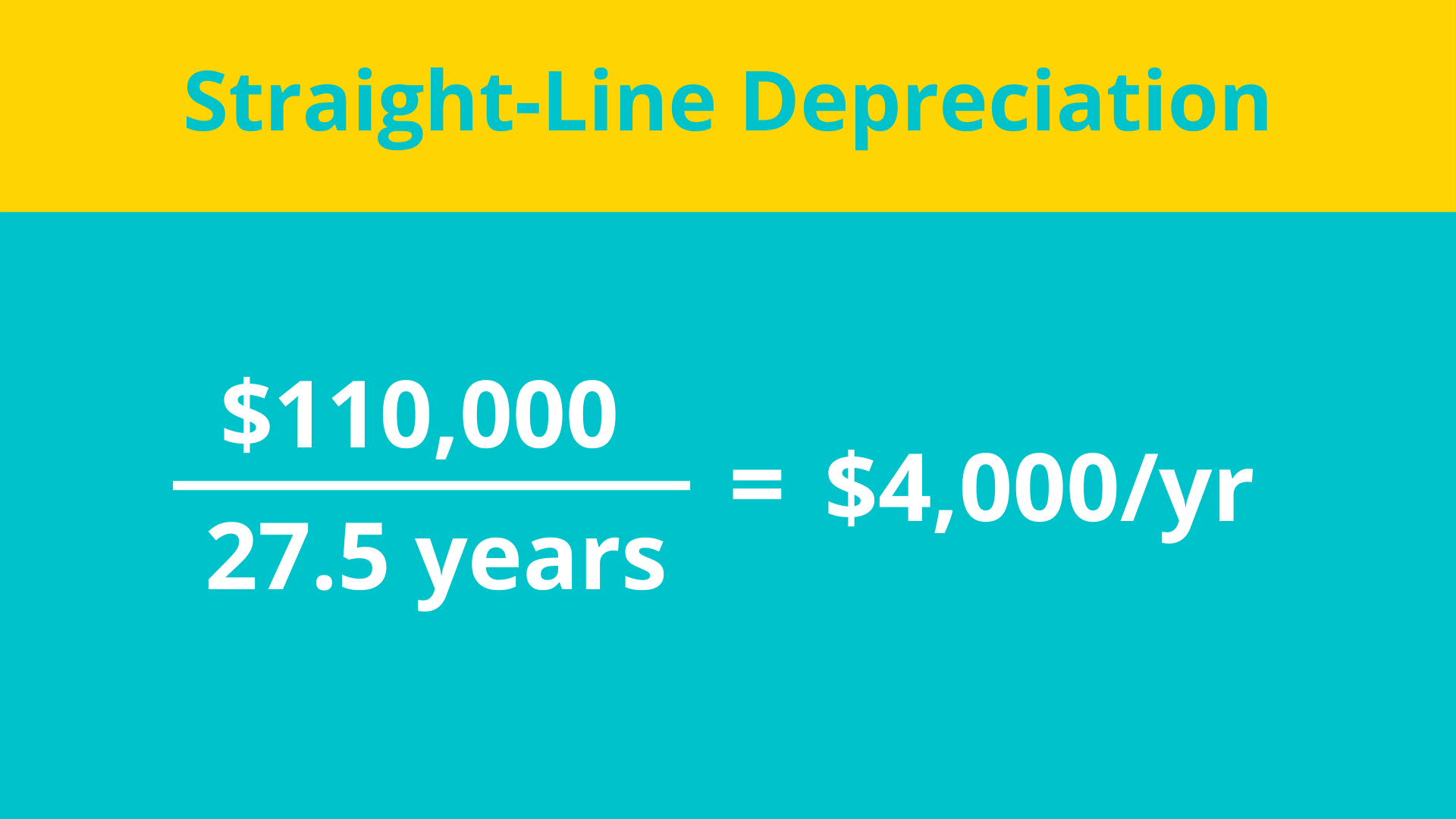

For example, let’s say an investor purchases a house for $120,000, and the land value is $10,000. One way to calculate the depreciation expense is simply to divide the property value by 27.5 years. Because land doesn’t depreciate, the straight-line depreciation expense would be $4,000.

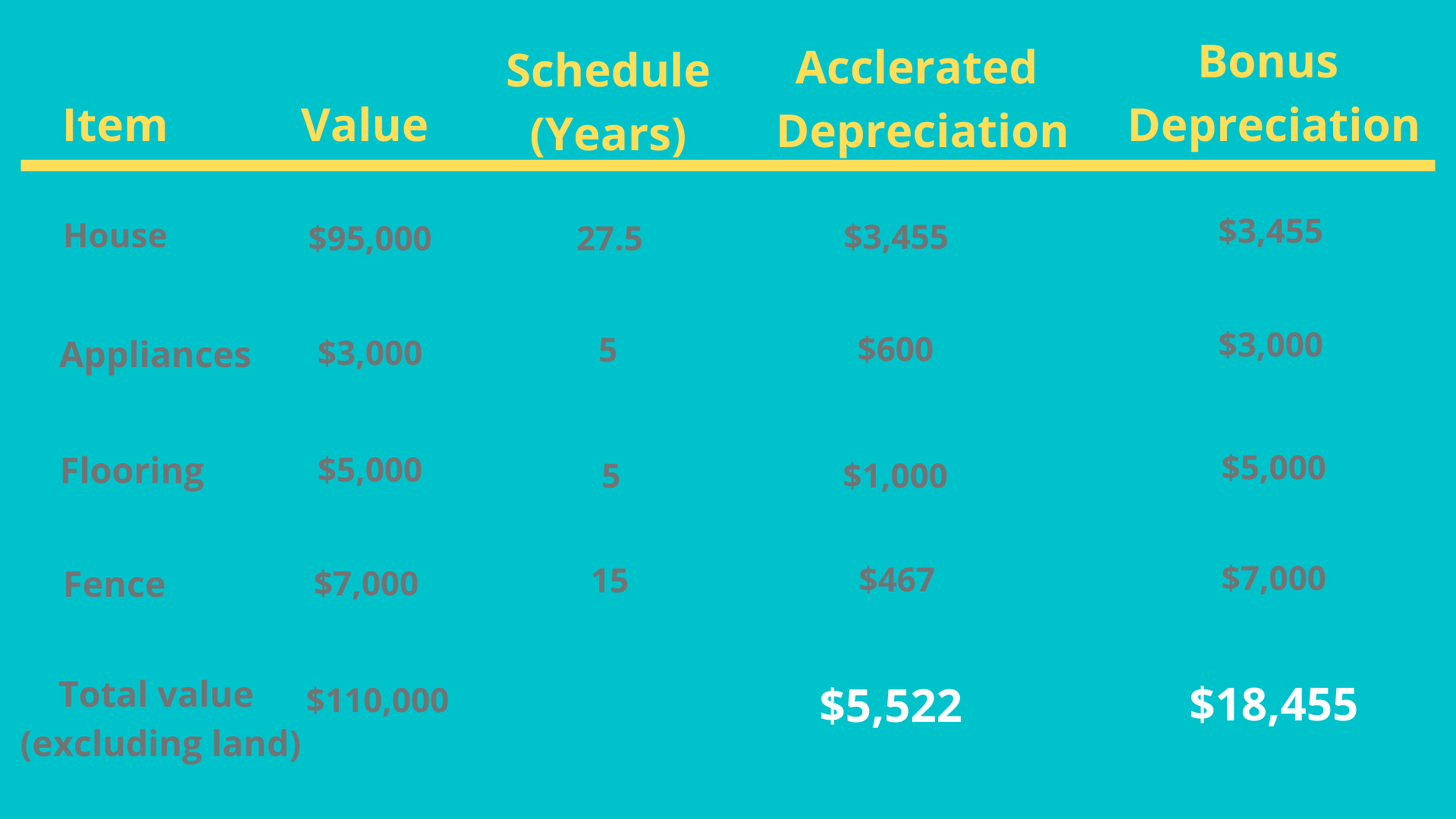

However, by conducting a cost segregation study, an investor may be able to claim bonus depreciation on a property. For example, assume that the house in this example has the following depreciation components based on a cost segregation study:

As illustrated above, an investor in this example may be able to increase the annual depreciation expense from $4,000 per year to $5,522 per year simply by conducting a cost segregation study.

But, by combining the power of bonus depreciation with a cost segregation study, the investor in this example is able to claim a total depreciation expense of $18,455 in the year the property is purchased.

This can be especially powerful because you can use the passive losses from one investment to offset income from other passive sources (i.e. if you have a taxable gain from the exit of another investment). Taking the large amount of depreciation upfront can shelter taxable income from other investments.

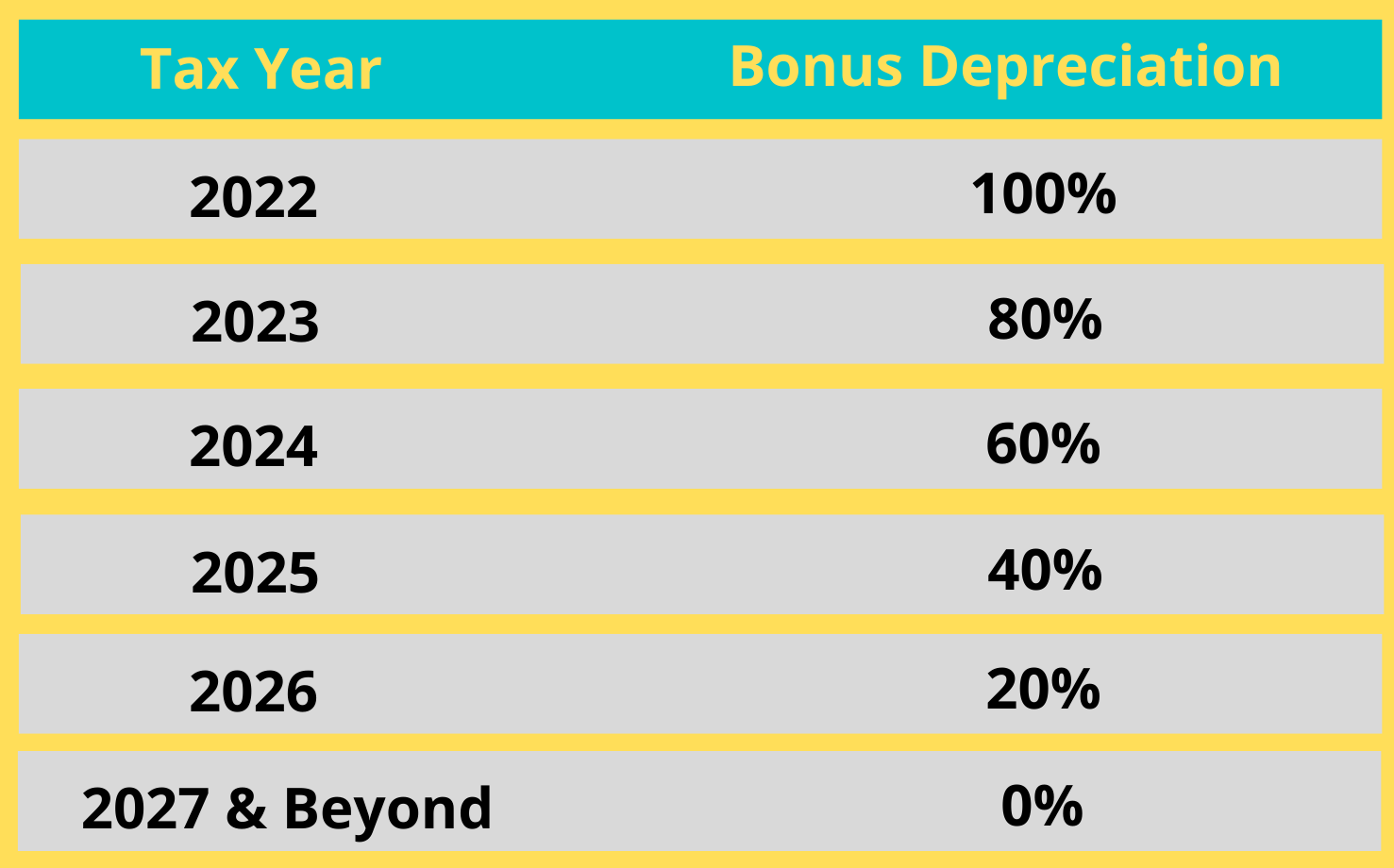

Bonus depreciation is gradually being phased out over the next couple of years. The 2022 tax year was the last year for 100% bonus depreciation.

Depreciation Recapture

Real estate has great tax benefits, but there’s never a free lunch with Uncle Sam. Depreciation recapture is something you should plan for as an investor.

It’s important to remember that depreciation is just a game of kicking the can down the road. Eventually the road ends and Uncle Sam is going to come looking for his cut when the property sells.

At some point (unless you’re able to utilize strategies like the 1031 exchange or a Delaware Statutory Trust, which are rare with syndications), you’re going to be faced with depreciation recapture.

When the property is sold, you will have to “recapture” the depreciation you took. This means you have to claim the depreciation back as income and pay taxes on it.

Conclusion

Investing in real estate syndications allow you to capture various tax benefits, one of the most powerful being depreciation. Although real estate generally increases in value over time, the IRS allows you to claim depreciation as if it were losing value.

These depreciation losses often completely offset the passive income earned during the life of the syndication. While you do have to pay this back as depreciation recapture when the property sells, there are still net benefits to deferring those taxes.

Do you pay alot in taxes? Have you benefited from real estate depreciation?