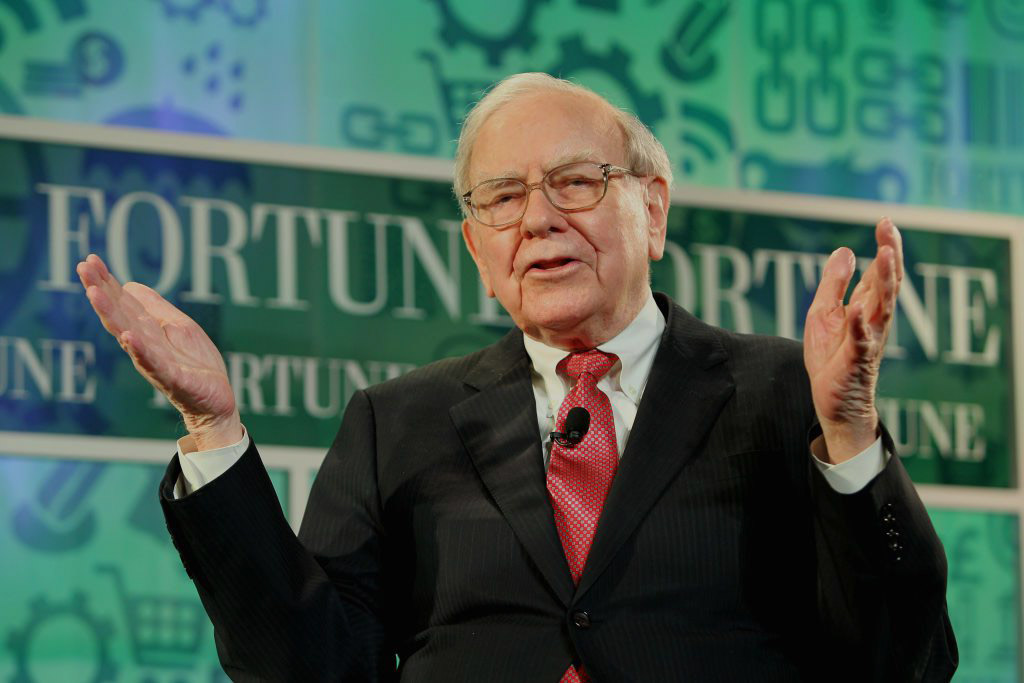

Investing Lessons from Warren Buffet

Warren Buffet is one of the most successful investors of our time, with an estimated net worth of over $100 billion. Over the years, he has shared his insights and wisdom with investors around the world, offering valuable lessons on how to invest wisely.

Here are four key investing lessons we can learn from Warren Buffet:

#1. Never invest in anything you don’t understand

This is perhaps the most important lesson that Warren Buffet has emphasized over the years. He has always advocated for investing only in businesses and industries that you have a deep understanding of. This means doing your homework and researching the company, its products, its financials and its management team. It also means avoiding investments that are too complex or opaque, or that you don’t have a clear understanding of.

Buffet has famously avoided investing in technology companies because he does not fully understand their business models. While this may have cost him some potential gains, he has also avoided some high-profile tech investments that later turned out to be disasters, such as the dot-com bubble in the late 1990s.

#2. Perform careful and thorough research

Warren Buffet is known for his rigorous approach to research and analysis. He spends hours reading financial statements, company reports and industry publications to get a complete picture of a company’s performance and prospects. He also looks at a company’s competitive advantages, such as its brand, intellectual property and distribution channels.

Buffet has famously said that he likes to invest in companies with a “moat” – a sustainable competitive advantage that protects the company from competitors. By doing thorough research, he can identify these moats and invest in companies that have a good chance of long-term success.

#3. Invest in things that even a fool can run

Warren Buffet has always looked for companies that have simple and easy-to-understand business models. He prefers businesses that are easy to operate and require minimal management or technical expertise. This means investing in companies with a clear value proposition, a loyal customer base and a strong brand.

Buffet has famously invested in companies like Coca-Cola and Gillette, which have simple and straightforward business models. He has also avoided investing in companies that are highly complex or that require a lot of technical expertise, such as biotech or high-tech firms.

#4. Invest for the long-term

This means having patience and discipline when it comes to investing, and not being swayed by short-term market trends. This approach involves purchasing investments and holding onto them for the long-term, often years or even decades, rather than actively trading or trying to time the market.

Buffet has famously said that his ideal holding period is “forever.” He believes in investing in high-quality companies that have a strong track record of performance and a sustainable competitive advantage, and then holding onto them for the long term. By doing this, he can benefit from the power of compounding, as his investments grow over time and generate increasing returns.

Bottom Line:

Warren Buffet’s investing lessons can offer valuable insights for both novice and experienced investors. By focusing on understanding, research, simplicity, value and long-term holding strategies, investors can build a strong and sustainable investment portfolio.

These lessons emphasize the importance of discipline, patience and a long-term view, which can help investors avoid short-term pitfalls and achieve long-term success.