The 4 Phases of the Real Estate Cycle

Real estate follows a cyclical pattern called the real estate cycle and consists four stages in a sequential pattern: recovery, expansion, hypersupply and recession.

Why Should You Care About the Real Estate Cycle?

So you may be wondering, “Why should I care about the real estate cycle?” The real estate cycle sounds like stuff for the academics to debate about and write papers about.

But knowing where in the cycle the market is and where it’s heading is important to being a successful real estate investor. The real estate cycle help us understand how the market is moving, predict what may be on the horizon and drive decisions on how to invest.

The Real Estate Cycle Operates Locally

Although the real estate market is often talked about from a broad perspective (i.e. the entire United States), the fact is that real estate is hyperlocal. As such, the real estate cycle is also microfocused.

Market cycles vary substantially from one market to the next, from one city to the next, and from one neighborhood to the next. So you can’t say, “Atalnta is over supplied” because there are pockets of Atlanta that still need housing and other parts of Atlanta that are in a recession.

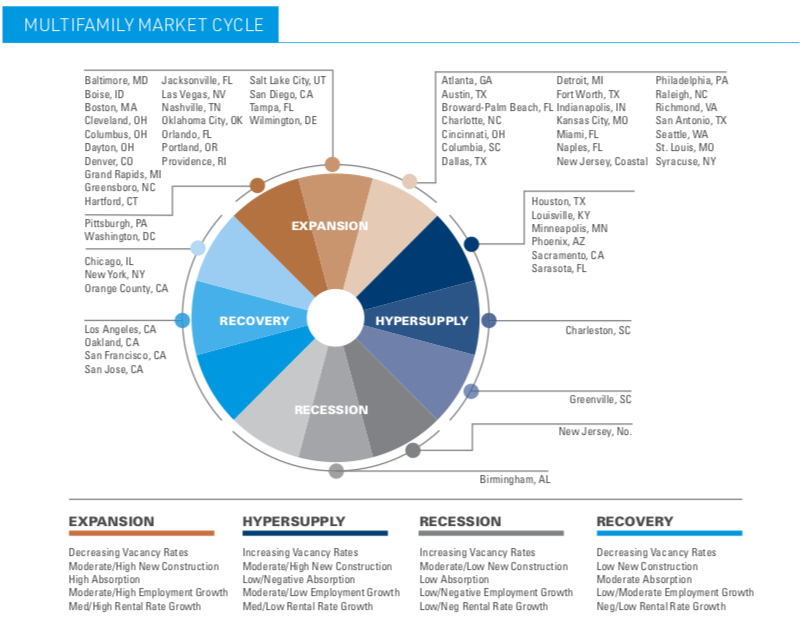

Below is a chart from the most recent report by Integra Realty Resources (IRR), a commercial real estate market research and consulting company. As you can see, while one city may be in the recession phase, another metropolitan area may be in the expansion phase.

Now let’s go over each of the four phases of the real estate cycle.

The 4 Phases of the Real Estate Cycle

1. Recovery

In the recovery phase of the cycle, there is stagnant rent growth, low occupancy and no signs of new construction. This is where real estate investors can get great deals and buy below-market value properties. However, securing financing during this phase of the cycle may be difficult.

2. Expansion

The expansion phase is characterized by strong job growth, rising rental rates and an increased demand for housing. Cap rates compress during this phase, as property prices rise and properties sell quickly.

As the cycle goes further in the expansion phase, investors tend to be cautious of heavy value-add deals and instead focus on deals that are newer and have less capital expenditures. In this part of the cycle, you’re paying more for value-add deals and the cap rates for newer A class properties may be very close to the cap rates of C class properties (older, more deferred maintenance).

3. Hyper Supply

Investors get into a frenzy during the expansion phase and there comes a point where supply begins to exceed demand (either from too much inventory or because of a shift in the economy where there’s less demand, as is the case nowadays with rising interest rates/cost of capital).

In this phase, vacancy increases and rent growth slows down. During this part of the cycle, investors may look for properties that have the potential to increase net operating income (NOI) without doing any significant rehab. They look for properties with operational inefficiencies that they can increase value through better operations. In the hypersupply phase of the cycle, investors also look to secure long-term, fixed-rate financing so that debt doesn’t become due during the upcoming recession.

4. Recession

During this phase, supply greatly exceeds demand, vacancy rates are high and rental rates decline. A recession offers the opportunity for investors to purchase properties at a deep discount.

This part of the cycle offers a great opportunity to buy value-add deals and reposition those assets. However, debt is often difficult to secure and creative financing is more common.

Conclusion

The real estate cycle is a concept that real estate investors should understand. Real estate investors can find opportunities and employ strategies in each of the four phases of the cycle.

What phase of the real estate cycle do you think we’re currently in? Are you shifting your investing strategy? Join the discussion by leaving your comment below.