Every real estate investor knows that it’s all about location, location, location. The only thing you cannot change about a piece of real estate is where it’s located.

As a passive investor, it can be overwhelming because that location can be anywhere in the country: east coast, west coast, south, southeast, midwest. And even after narrowing down a region, state and metropolitan area, you have to know the specific submarket you’re investing in. All that to say, where you invest in matters.

When evaluating syndication deals, you want to be investing in emerging and growth markets. These are markets where people are moving to, where jobs are expanding and where incomes are growing.

Although there are many factors to consider when evaluating a market, the three key indicators to look for are population growth, job growth and income growth. In this article, we’ll talk about why each of these components are important and illustrate an example with a market that I live and invest in: Atlanta, Georgia.

#1. Population Growth

You want to choose a market where people are moving to. A growing population means more potential renters and a high demand for housing, which leads to high rental occupancy rates. And high occupancy rates means reliable, stable cash flow. In contrast, investing in a market with a declining population makes it harder to find tenants.

You want to find an area with a long-term upward population growth (not just a temporary bump). For instance, I like to look at markets with the following characteristics:

- A large, pre-existing population of at least 500,000

- Steady, long-term population growth exceeding the national average

- Strong net migration growth exceeding the national average

#2. Job Growth

Second, you want to choose a market where there are jobs. People typically move to an area for jobs, which drives up the demand for housing and drives up rents.

More jobs = more residents = more likely to maintain a strong tenant base.

But strong job growth is only one piece of the equation, you also want an area with a variety of industries supporting the local economy. A diversified employment base is important for several reasons:

- It indicates a stable market with potential for future growth.

- Residents have more job options and a higher chance of finding a job.

- Reduces the risk that the local economy will be impacted negatively by any one industry.

#3. Income Growth

The third major factor to examine when evaluating a market is income growth. What residents can afford to pay for housing depends on their income. The general rule of thumb is to spend no more than30% of one’s gross income on rent. With a growth in income, there is the ability to raise rents to a level that residents can still afford, and also reduces the risk of rental payment defaults.

Market Spotlight: Atlanta, Georgia

Now let’s look at these three key metrics in relation to a market I know very well: Atlanta, Georgia. I’ve lived in Atlanta for the past 10 years and started my real estate investing career here.

#1. Population Growth

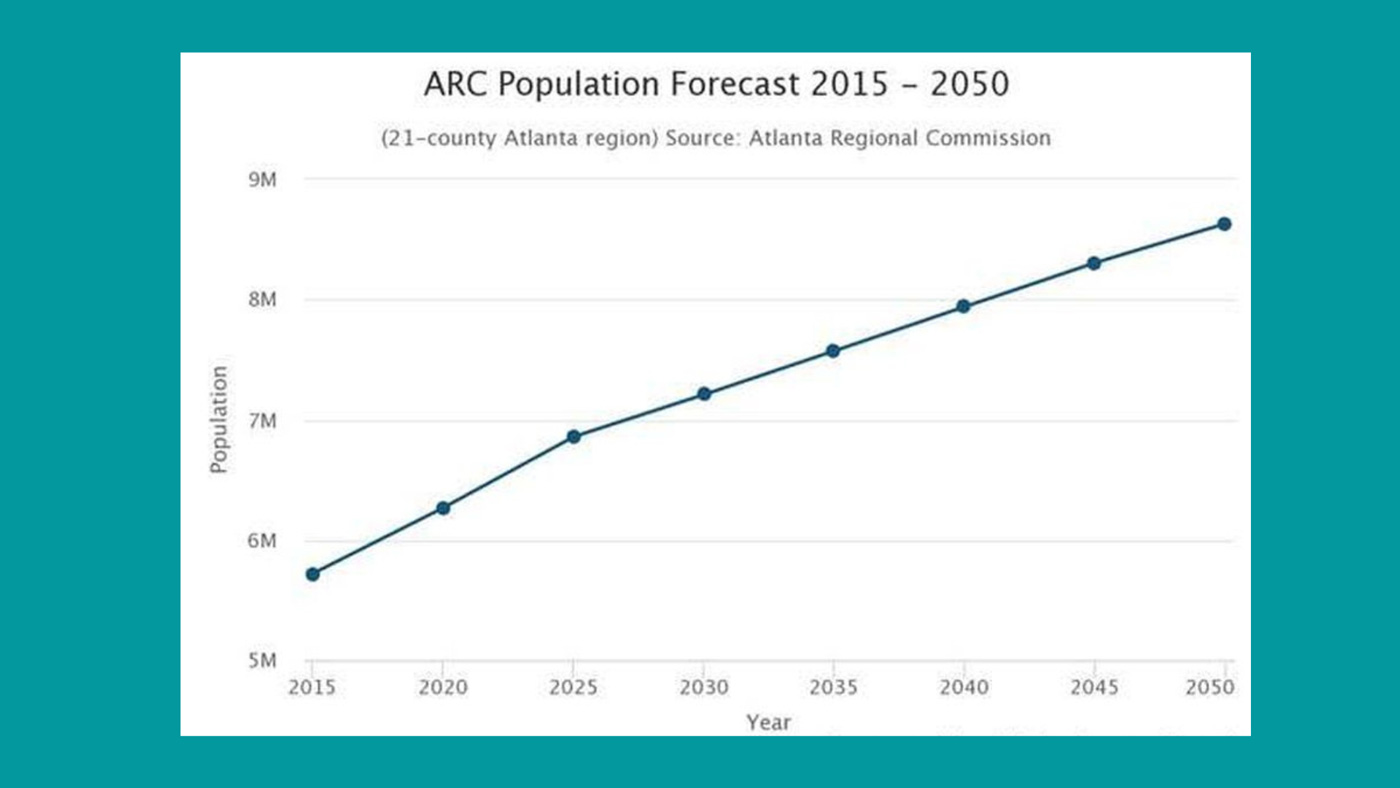

Atlanta has a consistent growing population. In 2010, the Atlanta metro area had 5.3 million people. Currently in 2022, the population is over 6 million and expected to grow to 8.6 million by 2050. Atlanta has consistently grown by 80,000 people per year, with no signs of slowing down.

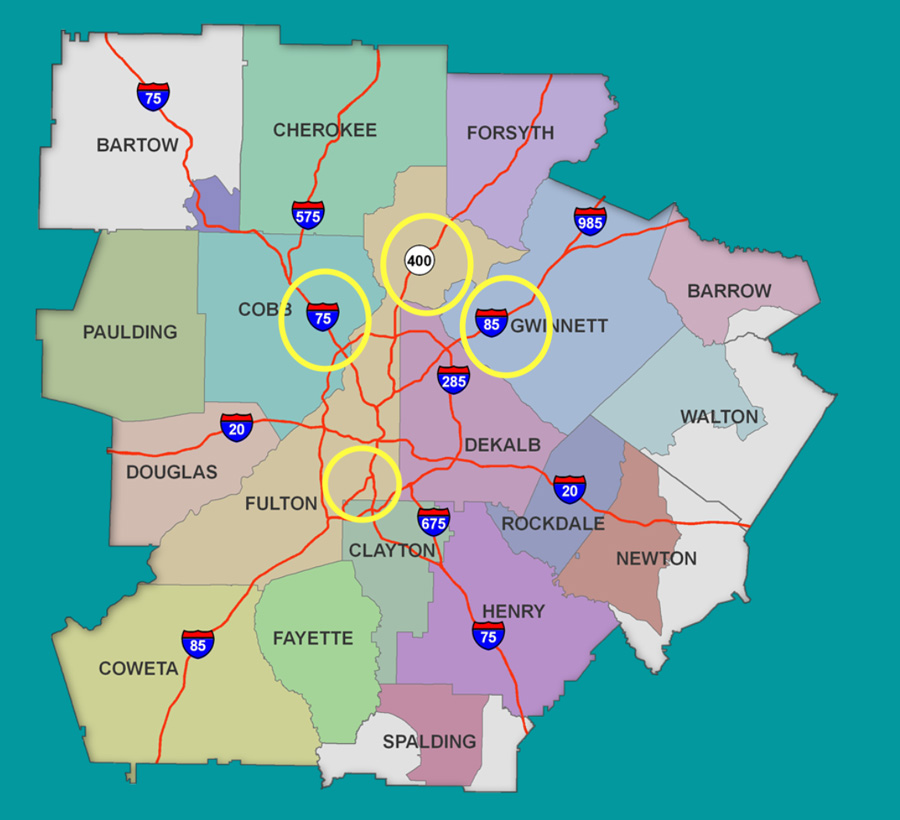

Of course, real estate is hyperlocal. Even within the Atlanta metro, there are certain areas that are growing more than others. According to the Atlanta Regional Commission, the biggest population booms are expected around intown Atlanta, the northern suburbs along Interstate 75, 85, and Georgia Highway 400, and near Hartsfield-Jackson International Airport.

# 2. Job Growth

There is significant job growth in the Atlanta metro area. The current unemployment rate in Atlanta is 3.9% (Bureau of Labor Statistics). The Atlanta Regional Commission estimates that 1.2 million jobs will be added by the end of 2050.

There are also diverse job sectors, including healthcare, science, technology, entertainment, higher education, manufacturing and tech. If any one sector takes a nosedive, the market will still be okay.

Major companies are headquartered in Atlanta, including sixteen Fortune 500 companies like Home Depot, UPS, Delta Airlines, and Coca-Cola. In addition, several large corporations (i.e. Microsoft, Google, Visa, Cisco) have announced expansions into Atlanta, resulting in many jobs being added to the area.

So Atlanta continues to attract both employers and employees to the area. More jobs mean more people, and more people means more demand for housing.

#3. Income Growth

The per capita and median household income has grown consistently in the Atlanta metro area, and is above average compared to the average US income. Household income growth is one of the fundamental drivers for rent increases, and thus affects property valuations.

Conclusion

As a passive investor, you must conduct thorough due diligence on the markets you’re interested in investing in. A solid market mitigates risk and ensures that deal has the best chance of succeeding.

During economic downturns and recessions, different real estate markets react differently. Our fundamental belief at Clear Vision Investing is that choosing the right asset in the right market with the right sponsor insulates your investment risk.

If you’re ready to see how we vet real estate markets and syndication deals, and want an opportunity to invest in our upcoming deals, I invite you to join the Clear Vision Investor Club today.