Preferred Returns in Real Estate Syndications Explained

If you’re been looking at real estate syndication, you’ve probably come across something called “preferred return,” also referred to as a “pref.”

In this article, we’ll go over what a preferred return is and how preferred returns work in syndication deals.

What is a Preferred Return?

Let’s start off by clarifying what a preferred return is not. A preferred return is NOT a guaranteed return.

A preferred return simply means that the investor is in a preferred position. This means that the investors get paid a percentage of the returns before the sponsors get anything. The investors get 100% of the distributions until that preferred return is met.

For value-add properties, sometimes the first few years of the property has low cashflow and does not meet the preferred return number. It’s important to note what happens if the preferred return is not meant for a particular year.

Look at the wording in the operating agreement to see whether the preferred return is cumulative or non-culumative. If it’s cumulative, then if the preferred return has not been fully satisfied in any given year, the balance due will carry over to the next year.

In contrast, if the preferred return is non-cumulative, then if in any year the return is not met, the balance does not carry over to the next year. Non-cumulative preferred returns are not common, but look carefully at what the operating agreement says.

How Preferred Returns Work: An Example

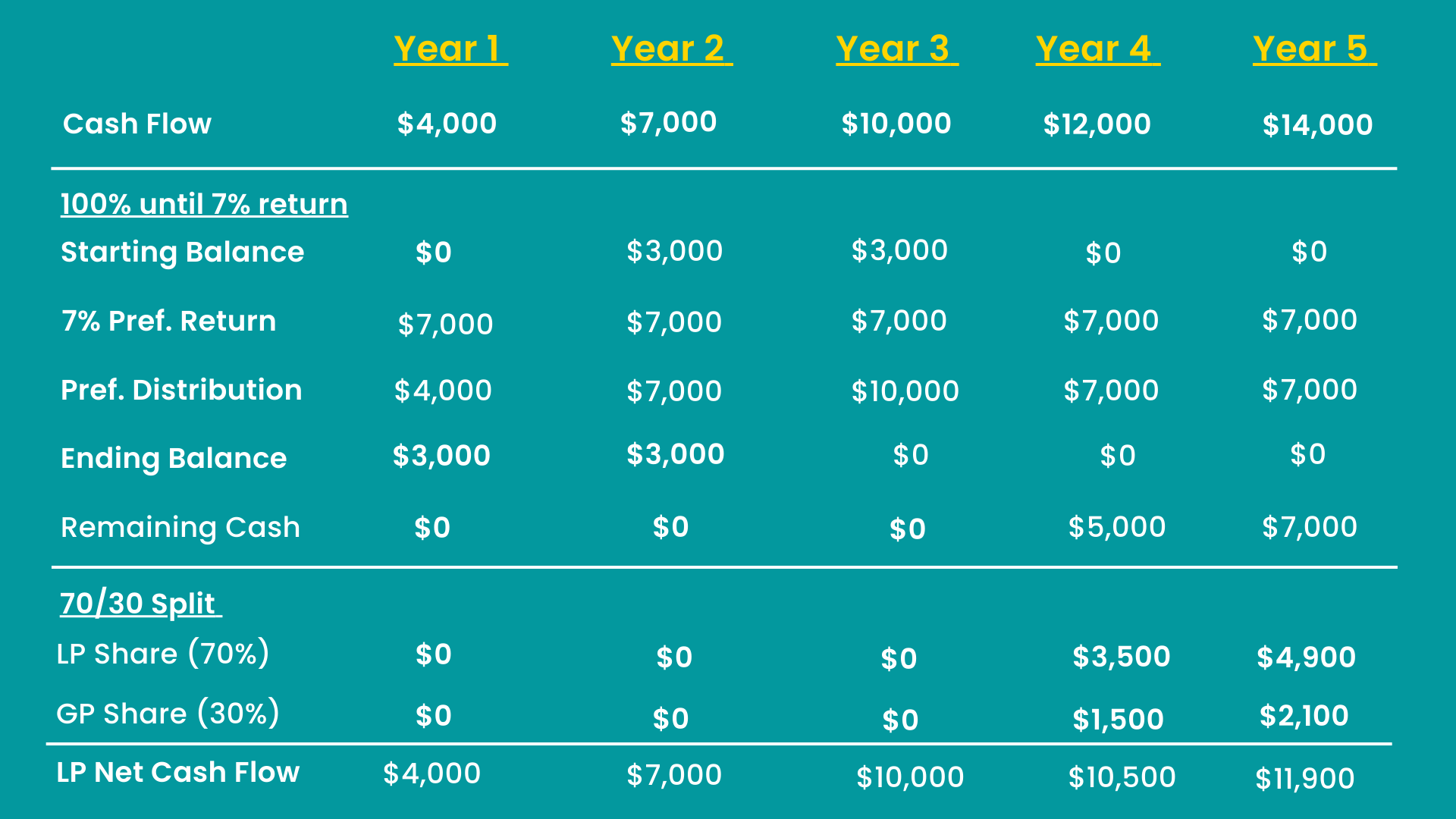

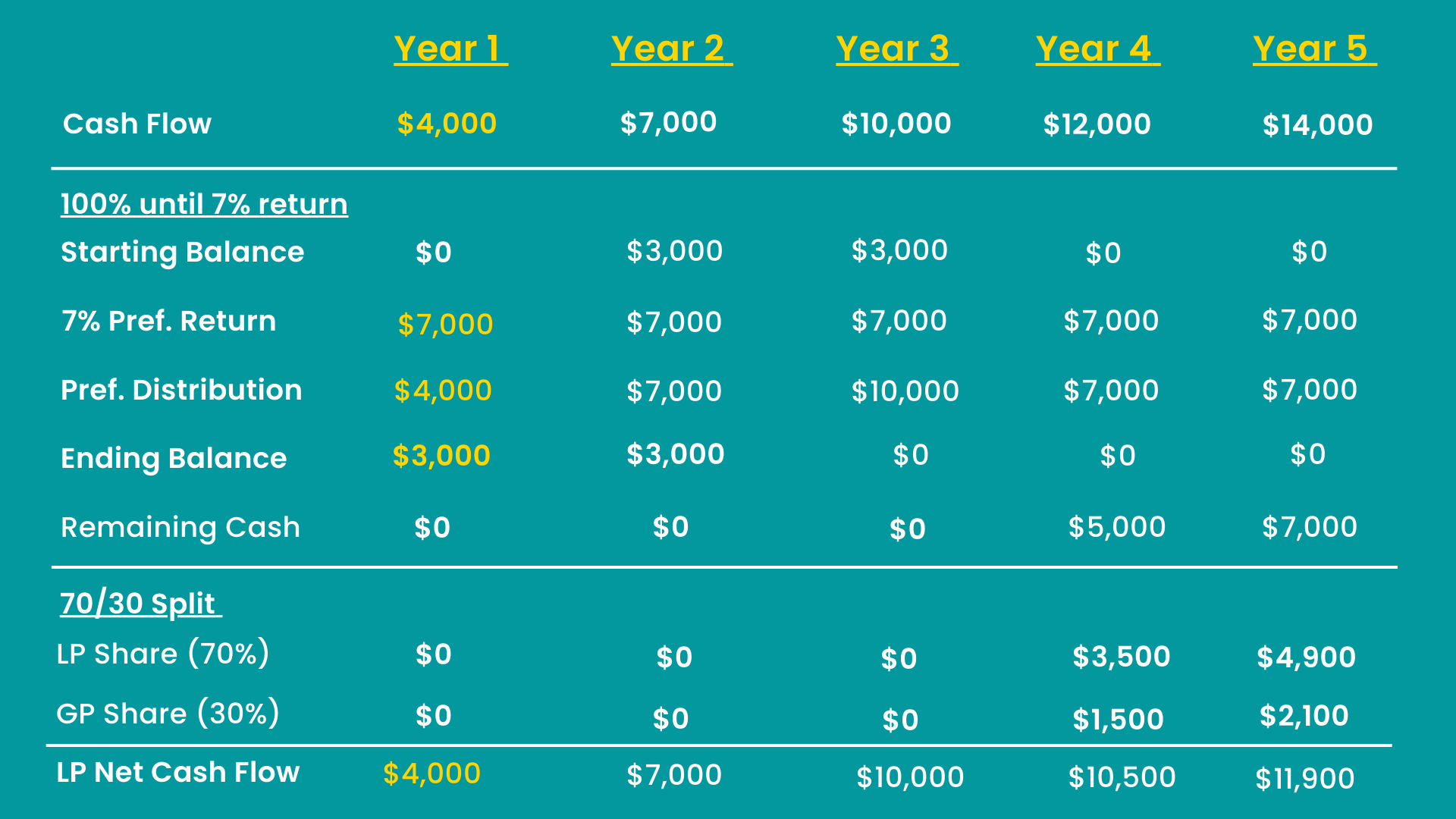

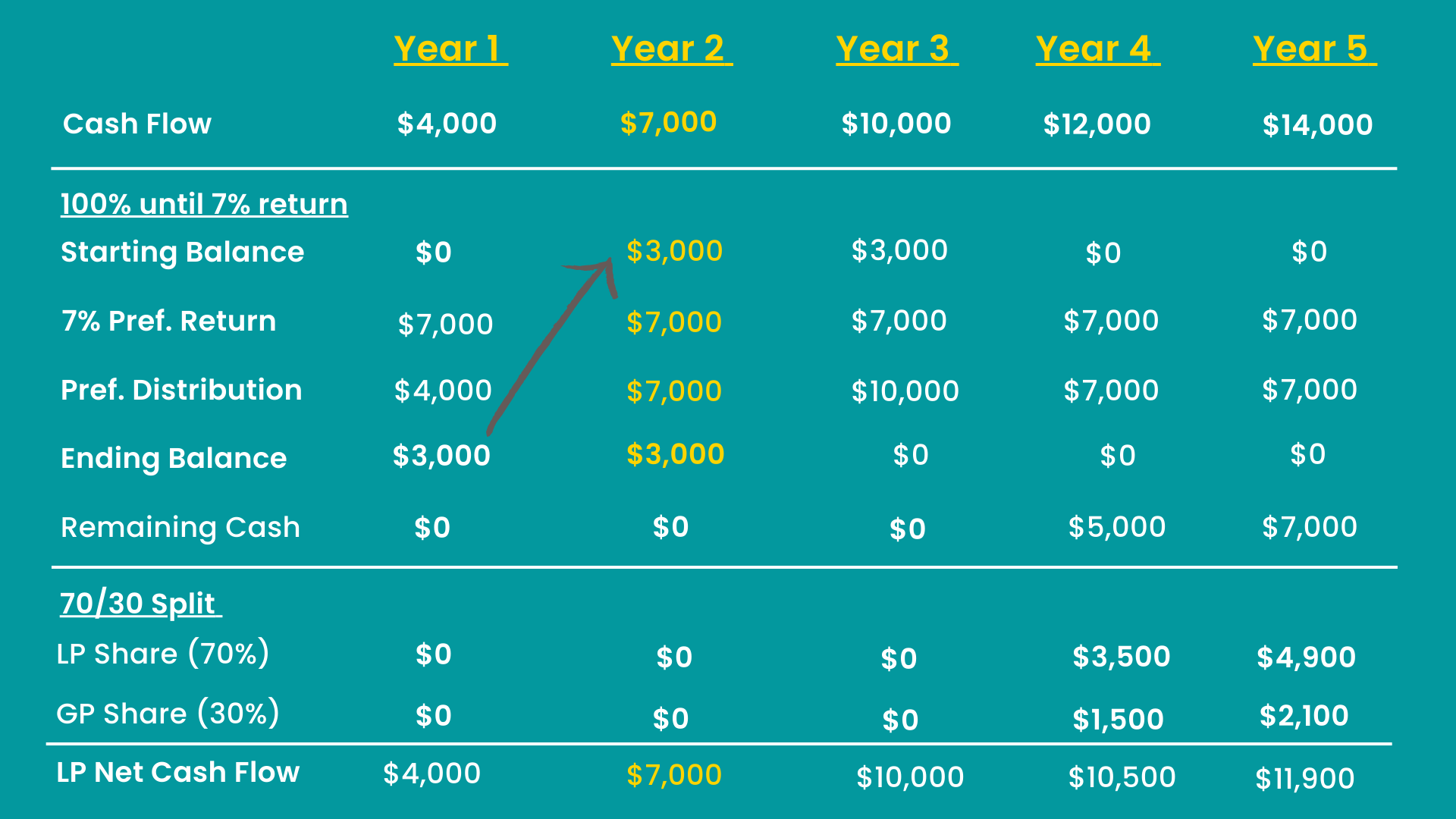

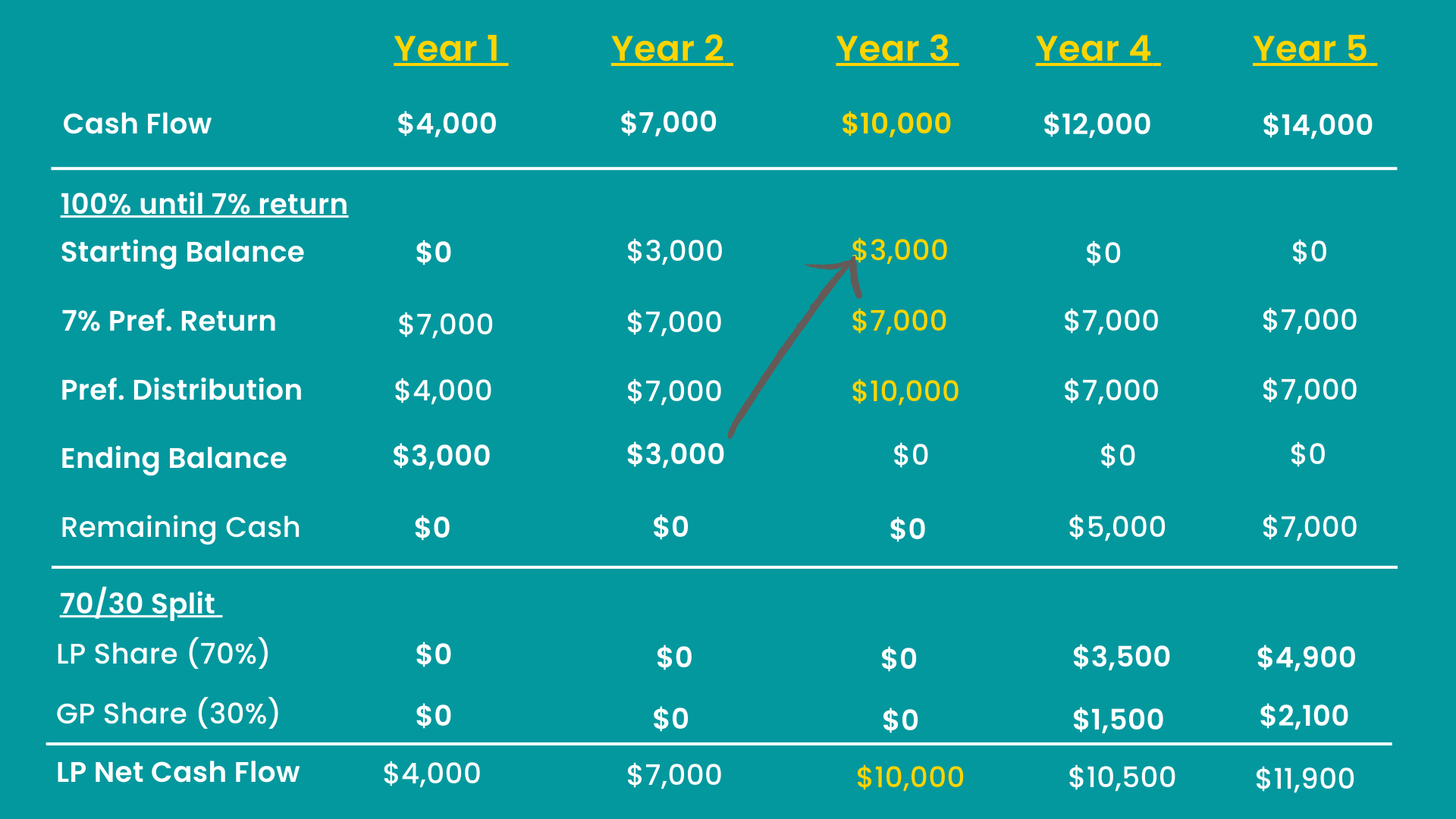

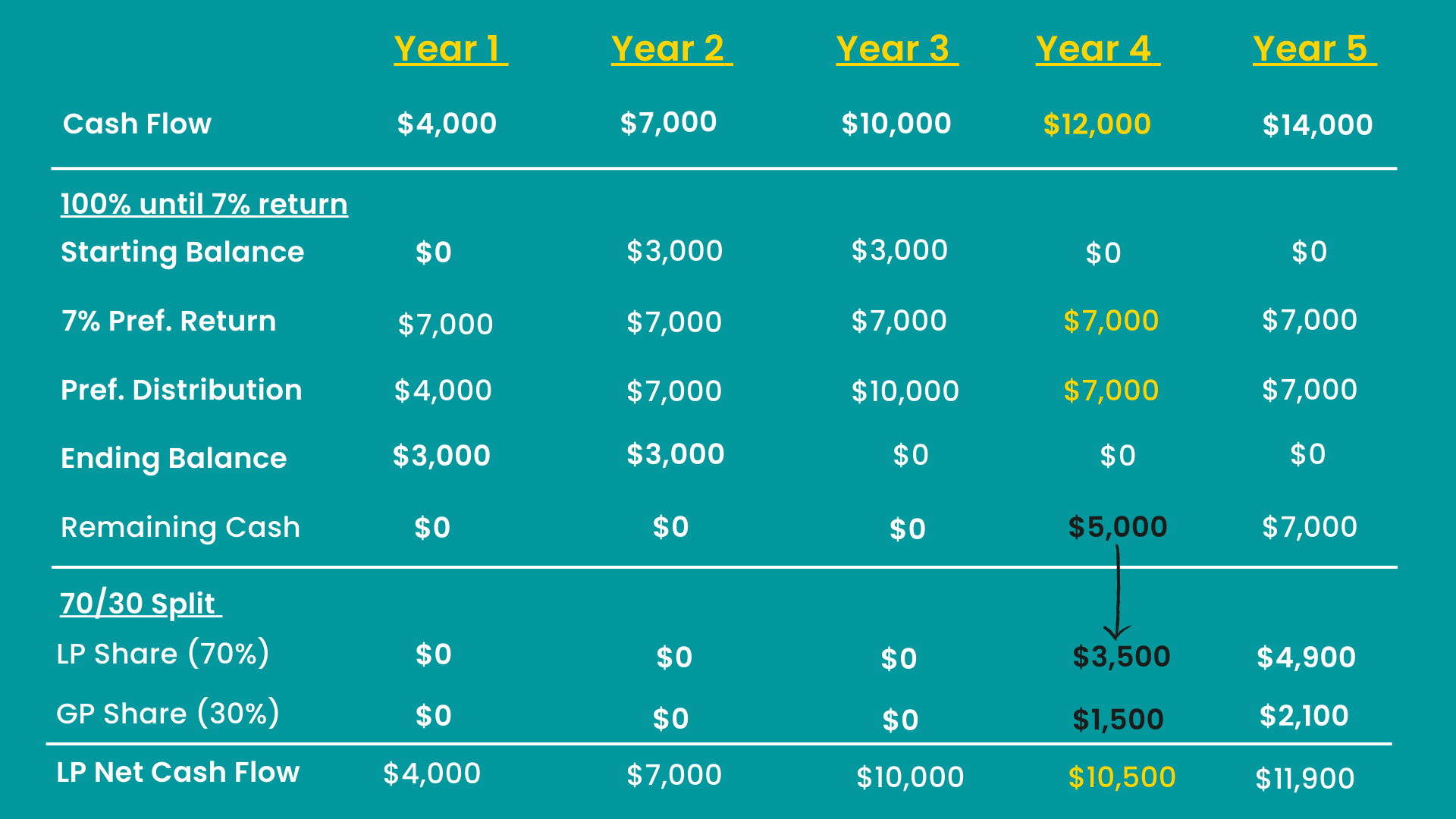

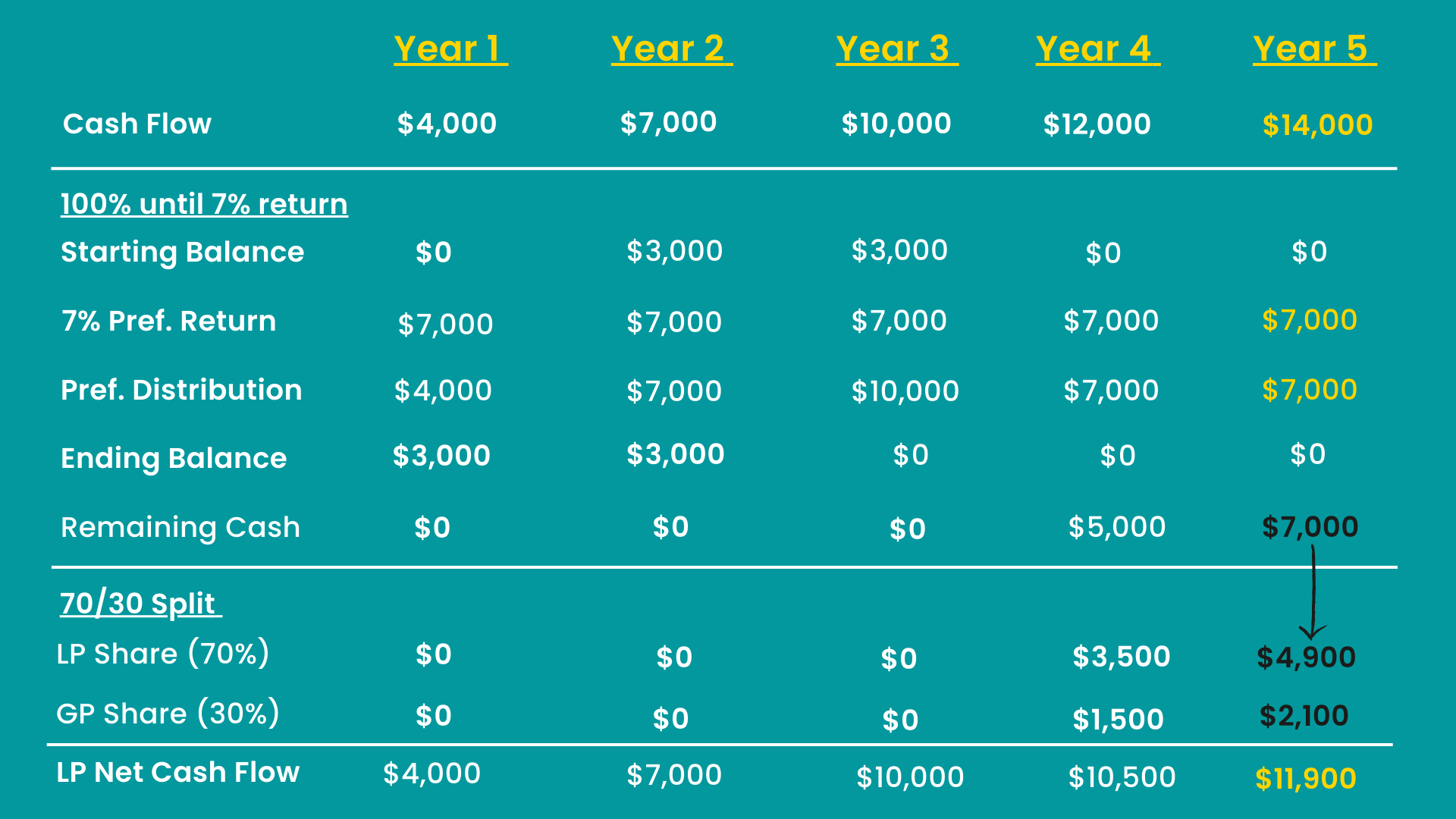

Let’s look at an example to see how preferred return distributions work. Let’s say you invested $100,000 into a real estate syndication with a 7% preferred return that’s cumulative but non-compounding. Anything above the 7% preferred return is split 70/30 (70% to the investors/limited partners and 30% to the general partners).

To calculate the preferred return, you multiply the money you invested ($100,000) by the preferred return rate. In this case, it would be $100,000 x 7% = $7000.

What this means is that you must receive $7000 each year before the sponsor gets anything. If the distributions are less than $7000, the sponsor receives nothing. Since the preferred return is cumulative in this example, if for any given year the preferred return hasn’t been met, the balance due carries over to the next year.

Below is how the cashflow will be distributed during the life of this example

1. Year One: In year one, there’s $4000 to distribute to you. That’s less than the 7% preferred return for year 1 (which should be $7000), so the investor gets all the $4000. The $3000 undistributed preferred return carries over to the next year.

1. Year 2: You are owed $3000 in undistributed preferred return from year 1, plus another $7000 for year 2, which equals a total of $10,000. There’s only $7000 to distribute, which is less than what the preferred return due, so the investors get all of the $7000. The $3000 of undistributed preferred return carries over to the next year.

2. Year One: Year 3: You are owed $3000 in undistributed preferred return from year 2, plus another $7000 for year 3, for a total $10,000. In this year, there’s $10,000 to distribute, so all of the $10,000 goes to the investor.

3. Year One: 3. Year 4: Now you are not owed any undistributed returns from year 3, but are owed $7000 for this current year. There’s $12,000 of cashflow to distribute, so you get $7000 to satisfy the 7% preferred return, and $4000 remains.

This remaining $4000 is then split 70/30, with 70% to the investor and 30% to the sponsor. So the investor gets $7000 in preferred return plus $3500 in excess cash, for $10,500 total.

4. Year One: Year 5: Again, there’s no residual undistributed preferred return from year 4. A preferred return of $7000 is due to you this year. There’s $14,000 to distribute. The distribution is greater than the preferred return of $7000, so $7000 goes to you to satisfy the preferred return and $7000 remains.

The remaining $7000 is split 70% to you as the investor and 30% to the sponsor. The investor gets $4900 and the sponsor gets $2100. So you get $7000 in preferred return and $4900 in excess cash, for a total of $11,900.

The Bottom Line

While preferred returns may seem complicated at first glance, keeping the basic concepts in mind will help you identify the payment structure in a real estate syndication deal. Simply knowing the terms and what they mean will boost your investing confidence.