Understanding 3 Important Real Estate Return Metrics

As physicians, we’re used to getting scores on exams. Think of how a whole semester or even years worth of work can boil down to a few numbers: MCAT scores, Step 1 and 2 scores, and passing our respective speciality board exams.

We like numbers because they paint a picture and tell a story. Similarly, we like to condense real estate syndication deals into a few simple numbers so we can form an opinion, compare options and decide whether to invest.

As a passive investor, there are three key return metrics you should know and understand: cash-on-cash return, equity multiple and internal rate of return.

So let’s dive in to each one of these:

#1. Cash-on-Cash Return (COC)

Cash-on-cash return (COC) is the annualized return relative to the initial amount of money you invested.

COC = (Annualized Return) / (Initial Investment)

For instance, if you invested $100,000 and received $10,000 of distributions in the first year, then your COC for that year is 10%.

COC is typically shown in two different ways: 1)Year-by-Year COC, which allows you to see the projected return in each year that the investment is held; and 2)Average COC, which takes the average value of each year’s COC returns.

It’s helpful to see both the year-by-year and average COC returns. For some projects, there may be low or zero cash flow in the first few years. For instance, value-add opportunities acquire an underperforming asset, make improvements and increase its value. These value-add investments may have lower cash flow initially but can rise quickly in the following years.

#2. Equity Multiple (EM)

The second return metric you should know is equity multiple (EM).

When someone talks about doubling or tripling their money, they’re referring to EM. Equity multiple is a nice way to determine your projected net return on an investment.

EM is calculated by the total distributions divided by the initial investment amount.

EM = (Total Distributions) / (Initial Investment)

By itself, EM isn’t all that useful because it doesn’t take into consideration the length of the deal.

Let’s say you invest $100,000 into a deal and get a total of $200,000 back (your original $100K investment and $100K in profit), then you achieved an equity multiple of 2x.

Sounds amazing, doesn’t it? Not so fast.

What if I told you that it would take 20 years to make that return? Well, all of the sudden, it doesn’t sound that great anymore.

But if I told you can get a 2x EM in five years, then your view of the investment would completely change.

So it’s important to interpret the EM in light of the project hold time. While equity multiple provides a nice snapshot of the investment’s overall profitability, it doesn’t account for how long the investor’s money is tied up or the distribution of cash flow throughout a project’s lifetime.

#3. Internal Rate of Return (IRR)

The third return metric you should know is the internal rate of return (IRR). The IRR is considered by most to be the gold standard for measuring and comparing returns in real estate syndications.

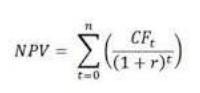

IRR is the discount rate that makes the net present value of all cash flows equal to zero.

Here’s the

formula for IRR:

Now that I’ve completely confused you and caused your eyes to gloss over all that, let’s talk about what IRR really means.

IRR basically measures the total time-adjusted return of an investment. It measures not just the amount of money returned to you, but also when that money was returned.

What separates IRR from all the other metrics is the inclusion of time into the equation.

Even if you have two investments with identical net returns (i.e. you get the exact same amount of money), the IRR can be completely different based on when you get those returns. The sooner you get the returns, the higher the IRR.

So why does it matter when you receive your money? There are two main reasons. The first reason is inflation. The value of a dollar decreases over time. Having $1 next year has less purchasing power than having a $1 today. The second reason is utility. Money is only as valuable as what you can do with it. Actual money is what you can use to buy things or to reinvest the money. There’s a lost opportunity cost if you don’t have the money to invest elsewhere to get a return.

So that’s why a dollar today is worth more than a dollar you receive next year or five years from now.

Conclusion

The three key performance metrics of a real estate syndication deal – the COC, EM and IRR – provides a good picture of an investment’s performance.

However, it’s important to note that behind the metrics are assumptions made to arrive at those numbers. So it’s important to examine those assumptions and make sure the COC, IRR and EM numbers makes sense.

Assuming the assumptions are reasonable and achievable, taking the IRR and EM together, then considering COC on both a year-by-year basis and average basis, can give you a pretty good picture of the performance of an investment.

What do you look for in an investment opportunity? Are you focused on any of these three metrics? What returns do you look for?

Interested in learning more about various real estate metrics and terminology? Click here to learn more.

Join the Clear Vision Investor Club to learn more about passive real estate investing opportunities.