Doctors are rich, right?

After all, there are more physicians and surgeons in the top 1% of earners than in any other profession.

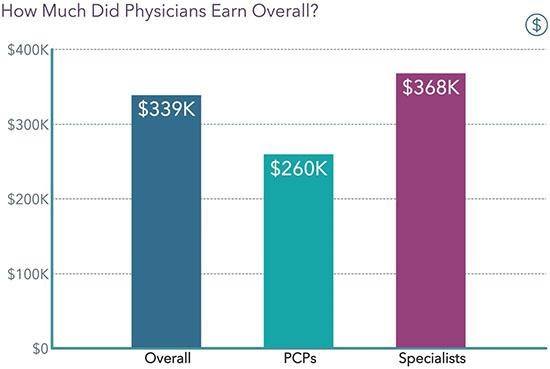

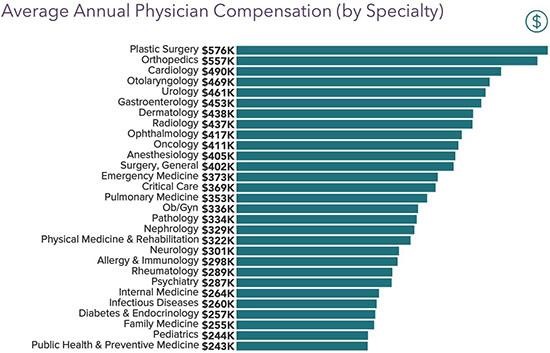

According to the 2022 Medscape Physician Compensation Report, the average physician income is $339,000 (with primary care physicians averaging $260,000 and specialists averaging $368,000).

But here’s the reality: many doctors are not rich.

You might be asking, “How can that be?”

The simple answer is: having a high income and being rich are two different things.

Here’s the basic explanation of why most doctors aren’t rich: It’s not how much money you make, but how you earn your money that matters.

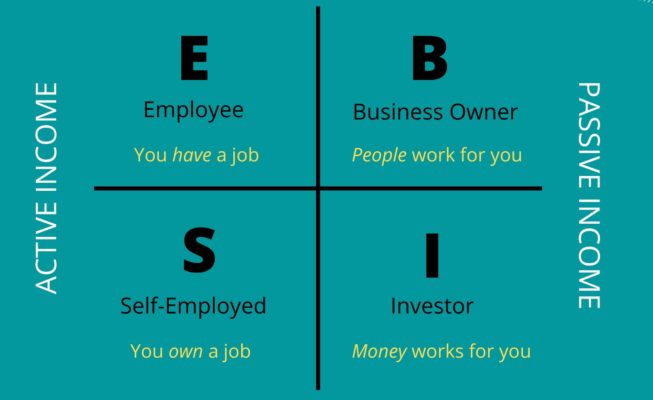

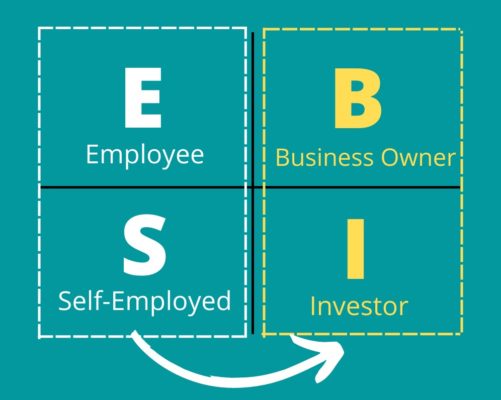

The Cashflow Quadrant, developed by Robert Kiyosaki, represents the different ways that money is earned. It helps us to understand why doctors aren’t rich and how doctors can be rich.

Cashflow Quadrant

Here’s the cashflow quadrant:

To start off, there are two important things to note about the cashflow quadrant.

First, each letter represents a different type of worker:

- E stands for employee

- S stands for self-employed

- B stands for business owner

- I stands for investor

Second, the cashflow quadrant is split vertically into two halves. On the left side, the E and S quadrants are paired together, and represent active income. On the right side, the B and I quadrants are paired together, and represent passive income.

Now let’s dive a little deeper into each of the four quadrants:

#1) E: Employee

An employee has a job. This is where most people earn their income.

If you’re a physician employed by a hospital or large healthcare corporation, then you fall into this category. You give your time, energy and skills to an employer in exchange for a paycheck and benefits.

The primary problem as an employee is the lack of control over your income. When you stop working, your income comes to a halt too. Your financial destiny, security and freedom is dependent upon the whim and the success of your employer. Taxes are also the highest for employees.

#2) S: Self-Employed

The self-employed choose to work for themselves and want to be their own boss.

If you’re a doctor who owns your own practice, you fall into this category.

While you do have more control, can set your own schedule, and decide who to hire or fire, you’re still trading your time for money. If you stop working, stop seeing patients or doing surgeries, your income stops coming in too.

#3) B: Business Owner

Those in the B quadrant own a system and lead people. The systems and people who work for the business can run it successfully without the business owner’s constant involvement.

The income you make is not proportional to the time you put in.

The main difference between a business owner and a self-employed is that you own the system as a business owner, while you own a job as a self-employed person.

#4) I: Investors

Investors own assets that produce income. This is the quadrant for truly passive income. Money works for you.

Examples of these types of investments include real estate, stocks, and royalties.

Investors have usually accumulated money earned in one or more of the other three quadrants, and they let the money go to work and produce even more money.

Investors also pay the lowest taxes than anyone in the other four quadrants.

Why Aren’t Doctors Rich?

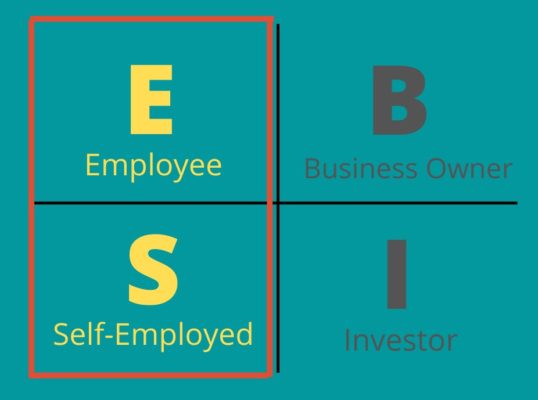

So now that you understand the Cashflow Quadrant, let’s answer the question, “Why aren’t doctors rich?”

The Cashflow Quadrant helps us answer this question.

Doctors are not rich because they live on the left side of the quadrant. They are either employees or self-employed, and trade their time for money.

They pay the most in taxes, have the least control, and the money they make is dependent on the time and energy they put in.

If they stop working, the money stops coming in.

So how can doctors be rich?

The way for doctors to be rich is to operate on the right side of the cashflow quadrant.

In essence, stop trading time for money, and start having a system work for you (as a business owner) or have money work for you (as an investor).

As a physician who earns a high-income, you have the opportunity to move quickly from the left to right side of the Cashflow Quadrant, particularly as an investor.

One of the most feasible ways for physicians to be an investor is to passively invest in real estate. Passively investing in real estate allows you to be an investor without taking up any more of your precious time, and helps you move to the right side of the quadrant.

So which quadrant are you currently in? Where do you earn most of your income?

Which quadrant do you want to be in and what’s your plan to move to that quadrant?

Interested in learning more about passive real estate investing? Start by joining our Clear Vision Investor Club.