Demystifying the Capital Stack for Apartment Syndications

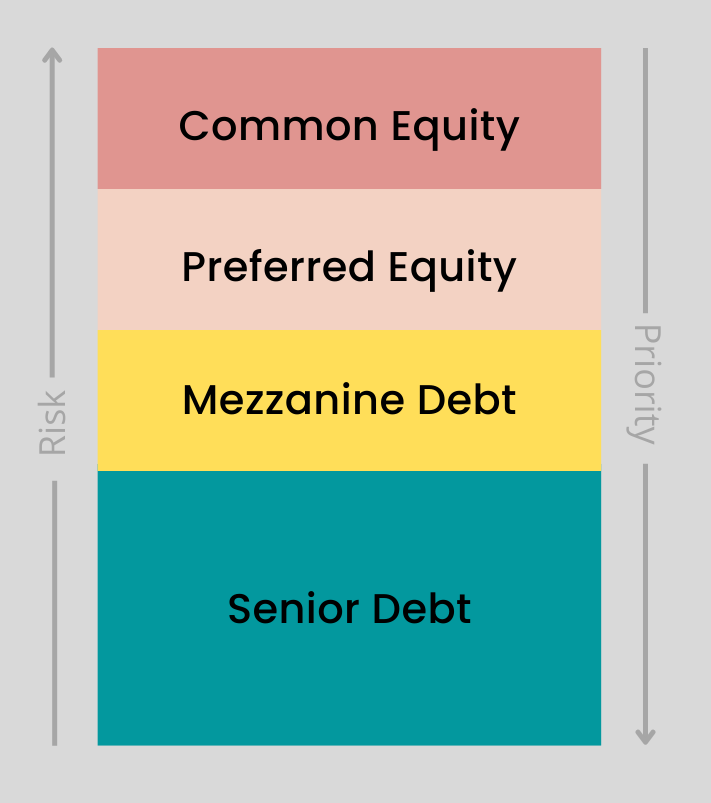

When investing in an apartment syndication, it is important to understand the capital structure of the transaction, along with the risks and rewards associated with each part of the capital stack.

What is a Capital Stack?

The capital stack is the total invested capital in a real estate investment. Think of it as how all the money for the investment came about. It’s simply the organization of all the debt and equity used to finance a real estate transaction. The capital stack determines who gets paid, how much, and in what order.

For a simple transaction like a single family home, the stack will likely only include debt from the bank at the bottom of the stack and the cash you put as a downpayment (equity) at the top of the stack.

However, when you’re purchasing a real estate asset that costs millions of dollars, there are more parties involved in the capital stack. For multifamily real estate, there are four main components of a capital stack: senior debt, mezzanine debt, preferred equity and common equity. As one moves up the capital stack, the risk and return profile increases. Senior debt is considered the lowest risk but also generates the lowest returns. Conversely, common equity carries the highest risk but offers the potential for the highest returns.

Let’s look at each component:

-

Senior Debt

Senior debt holds the highest priority position in the capital stack. This is the traditional debt you would get from a bank or lender. They will get their payment first before any other capital contributors are paid. When the property is sold, the senior debt holder also gets paid first, receiving any outstanding principal and accrued interest. Senior debt receives the lowest returns in exchange for being top priority.

-

Mezzanine Debt

Next, there may (or may not) be a second-position loan like a mezzanine debt. Mezzanine debt occupies the next position after the senior debt, giving it priority over all forms of equity. Mezzanine (which means “middle” in Italian) debt is repaid after senior debt, but prior to preferred or common equity.

This form of debt is used to fill in financing gaps. For example, if senior debt has been secured for 70% of the asset value and the sponsor has pledged their own capital and their investors’ capital to account for 20% of the equity, the remaining 10% could be filled by mezzanine debt. In return for filling these gaps, mezzanine loans charge the borrower a higher interest rate than traditional debt financing.

-

Preferred Equity:

Preferred equity is like the equity version of mezzanine debt, and is usually used to fill in financing gaps.

Preferred equity sits between debt and common equity in the capital stack. Preferred equity might take the form of a single institutional preferred equity partner (i.e. a company) or a preferred class of individual passive investors. Preferred equity investors typically get a higher, fixed-rate preferred return than investors further down the stack, but don’t share in the project’s equity growth.

Why would general partners want to use this class in a deal structure? Since preferred equity doesn’t share in the equity growth, this class actually lowers the overall cost of capital, which increases the returns from equity growth at sale for the common equity investors.

-

Common Equity:

Common equity is the equity investment made by both the general partners (GPs) and limited partners (LPs). Common equity holds the lowest priority position and sits at the top of the capital stack. They are the last to be repaid, and will be repaid only if others in the capital stack are repaid first. Therefore, common equity carries the highest risk but also has a greater potential for the highest returns.

Common equity holders share in both the cashflow and equity growth when the property sells. In a straight split, the common equity LPs sand GPs get paid together according to a predetermined split ratio.

With a preferred return, the common equity LPs have a higher position than the GPs. They get a percentage of the cash flow up to specified preferred return rate. Then they share in the cash flow or sales profits according to the split ratio.

Summary

The higher positions in the capital stack carry a higher risk but also have the potential for higher returns. Conversely, the lower positions in the capital stack have a lower risk but the returns are also lower. Understanding the capital stack in a deal is important because it lets you know who gets paid, in what order and how much risk they carry.